Smallbones (talk | contribs) →Ideology: use original video |

version update |

||

| Line 1: | Line 1: | ||

{{Short description|Decentralized digital currency}} |

|||

{{Redirect-distinguish2|₿|"฿" for [[Thai baht]]}} |

|||

{{for|the colloquial expression for coinage|Bit (money)}} |

|||

{{pp-protect|small=yes}} |

|||

{{Redirect-distinguish-text|₿|"฿" for [[Thai baht]]}} |

|||

{{Use dmy dates|date=June 2018}} |

|||

{{pp-extended|small=yes}} |

|||

{{Use dmy dates|date=March 2024}} |

|||

{{Use American English|date=December 2017}} |

{{Use American English|date=December 2017}} |

||

{{infobox cryptocurrency |

{{infobox cryptocurrency |

||

| currency_name |

| currency_name = Bitcoin |

||

| image_1 |

| image_1 = Bitcoin.svg |

||

| image_2 = |

|||

| image_title_1 = Prevailing bitcoin logo |

|||

| image_width_1 = 150 |

|||

| alt1 = Prevailing bitcoin logo |

|||

| image_width_2 = 110 |

|||

| subunit_ratio_1 = {{frac|1000}} |

|||

| image_title_1 = Logo |

|||

| subunit_name_1 = millibitcoin |

|||

| alt1 = Prevailing bitcoin logo |

|||

| subunit_ratio_2 = {{frac|100000000}} |

|||

| precision = 10<sup>−8</sup> |

|||

| subunit_name_2 = satoshi<ref name="satoshi unit">{{cite web |title = Cracking the Bitcoin: Digging Into a $131M USD Virtual Currency |url = http://www.dailytech.com/Cracking+the+Bitcoin+Digging+Into+a+131M+USD+Virtual+Currency/article21878.htm |author = Jason Mick |publisher = Daily Tech |date = 12 June 2011 |accessdate = 30 September 2012 |deadurl = yes |archiveurl = https://archive.is/20130120051306/http://www.dailytech.com/Cracking+the+Bitcoin+Digging+Into+a+131M+USD+Virtual+Currency/article21878.htm |archivedate = 20 January 2013 |df = dmy-all }}</ref> |

|||

| subunit_ratio_1 = {{frac|1000}} |

|||

| plural = bitcoins |

|||

| subunit_name_1 = Millibitcoin |

|||

| symbol = ₿{{efn|group=infobox|The symbol was encoded in [[Unicode]] version 10.0 at position {{unichar|20BF|BITCOIN SIGN}} in the [[Currency Symbols (Unicode block)|Currency Symbols block]] in June 2017.<ref name="unicode-10">{{cite web |url = https://www.unicode.org/versions/Unicode10.0.0/ |title = Unicode 10.0.0 |publisher = Unicode Consortium |date = 20 June 2017 |accessdate = 20 June 2017 |deadurl = no |archiveurl = https://web.archive.org/web/20170620130342/http://www.unicode.org/versions/Unicode10.0.0/ |archivedate = 20 June 2017 |df = dmy-all }}</ref>}} |

|||

| subunit_ratio_2 = {{frac|{{val|1000000}}}} |

|||

| ticker_symbol = BTC, XBT{{efn|group=infobox|Compatible with ISO 4217.}} |

|||

| subunit_name_2 = Microbitcoin |

|||

| coin_definition = [[Unspent outputs of transactions]] (in multiples of a satoshi)<ref name="Antonopoulos2014">{{cite book |author = Andreas M. Antonopoulos |date = April 2014 |isbn = 978-1-4493-7404-4 |publisher = O'Reilly Media |title = Mastering Bitcoin: Unlocking Digital Crypto-Currencies }}</ref>{{rp|ch. 5}} |

|||

| subunit_ratio_3 = {{frac|{{val|100000000}}}} |

|||

| implementations = [[Bitcoin Core]] |

|||

| subunit_name_3 = {{lang|ja-Latn|Satoshi|italic=no}}{{efn|name=satoshi}}<ref name="satoshi unit">{{Cite journal |last=Bradbury |first=Danny |date=November 2013 |title=The problem with Bitcoin |url=https://linkinghub.elsevier.com/retrieve/pii/S1361372313701015 |journal=Computer Fraud & Security |language=en |volume=2013 |issue=11 |pages=5–8 |doi=10.1016/S1361-3723(13)70101-5 |access-date=25 November 2023 |archive-date=18 January 2023 |archive-url=https://web.archive.org/web/20230118052355/https://linkinghub.elsevier.com/retrieve/pii/S1361372313701015 |url-status=live }}</ref> |

|||

| plural = Bitcoins |

|||

| symbol = '''₿'''<br/>(Unicode: {{unichar|20BF|BITCOIN SIGN|html=}})<ref name="unicode-10">{{cite web |date=20 June 2017 |title=Unicode 10.0.0 |url=https://www.unicode.org/versions/Unicode10.0.0/ |url-status=live |archive-url=https://web.archive.org/web/20170620130342/http://www.unicode.org/versions/Unicode10.0.0/ |archive-date=20 June 2017 |access-date=20 June 2017 |publisher=Unicode Consortium}}</ref> |

|||

| code = BTC |

|||

| implementations = [[Bitcoin Core]] |

|||

| initial_release_version = 0.1.0 |

| initial_release_version = 0.1.0 |

||

| initial_release_date |

| initial_release_date = {{Start date and age|df=yes|2009|1|9|p=y}} |

||

| code_repository = {{URL|https://github.com/bitcoin/bitcoin}} |

|||

| latest_release_version = 0.16.1 |

|||

| status = Active |

|||

| latest_release_date = {{Start date and age|df=yes|2018|06|15|p=y}} |

|||

| latest_release_version = 27.1 |

|||

| author = [[Satoshi Nakamoto]] |

|||

| latest_release_date = {{Start date and age|df=yes|2024|06|17|p=y}}<ref>{{cite web |title=Bitcoin Core Releases |url=https://github.com/bitcoin/bitcoin/releases |via=[[GitHub]] |access-date=17 June 2024 |archive-date=17 June 2024 |archive-url=https://web.archive.org/web/20240617165811/https://github.com/bitcoin/bitcoin/releases |url-status=live }}</ref> |

|||

| white_paper = [https://bitcoin.org/bitcoin.pdf "Bitcoin: A Peer-to-Peer Electronic Cash System"]<ref name="paper" /> |

|||

| forked_from = |

|||

| website = {{URL|bitcoin.org}} |

|||

| programming_languages = C++ |

|||

| block_explorer = {{URL|blockchain.info}} |

|||

| operating_system = |

|||

| ledger_start = {{Start date and age|df=yes|2009|1|3|p=y}} |

|||

| author = [[Satoshi Nakamoto]] |

|||

| hash_function = [[SHA-256]] |

|||

| developer = |

|||

| circulating_supply = ₿16,858,762 ({{as of|2018|2|11|lc=y}}) |

|||

| white_paper = [https://bitcoin.org/bitcoin.pdf "Bitcoin: A Peer-to-Peer Electronic Cash System"] |

|||

| supply_limit = ₿21,000,000 <ref>{{Cite web|url=https://github.com/bitcoin/bitcoin/blob/08a7316c144f9f2516db8fa62400893f4358c5ae/src/amount.h|title=Bitcoin source code - amount constraints|last=Satoshi et al.|first=|date=1 April 2016|website=|archive-url=|archive-date=|dead-url=|access-date=}}</ref> |

|||

| source_model = [[Free and open-source software]] |

|||

| timestamping = [[Proof-of-work system|Proof-of-work]] (partial hash inversion) |

|||

| license = [[MIT License]] |

|||

| issuance = Decentralized (block reward)<ref name="JSC">{{cite web |url = https://www.fincen.gov/sites/default/files/2016-08/20131118.pdf |title = Statement of Jennifer Shasky Calvery, Director Financial Crimes Enforcement Network United States Department of the Treasury Before the United States Senate Committee on Banking, Housing, and Urban Affairs Subcommittee on National Security and International Trade and Finance Subcommittee on Economic Policy |publisher = Financial Crimes Enforcement Network |work = fincen.gov |date = 19 November 2013 |accessdate = 1 June 2014 |deadurl = no |archiveurl = https://web.archive.org/web/20161009183700/https://www.fincen.gov/sites/default/files/2016-08/20131118.pdf |archivedate = 9 October 2016 |df = dmy-all }}</ref><ref name="tcdecentralized">{{cite news |last1 = Empson |first1 = Rip |title = Bitcoin: How an Unregulated, Decentralized Virtual Currency Just Became a Billion Dollar Market |url = https://techcrunch.com/2013/03/28/bitcoin-how-an-unregulated-decentralized-virtual-currency-just-became-a-billion-dollar-market/ |accessdate = 8 October 2016 |work = TechCrunch |publisher = AOL inc. |date = 28 March 2013 |deadurl = no |archiveurl = https://web.archive.org/web/20161009205955/https://techcrunch.com/2013/03/28/bitcoin-how-an-unregulated-decentralized-virtual-currency-just-became-a-billion-dollar-market/ |archivedate = 9 October 2016 |df = dmy-all }}</ref> |

|||

| ledger_start = {{Start date and age|df=yes|2009|1|3|p=y}} |

|||

| block_time = 10 minutes |

|||

| hash_function = [[SHA-256]] (two rounds) |

|||

| block_reward = ₿12.5{{efn|group=infobox|July 2016 to approximately June 2020, halved approximately every four years}} |

|||

| circulating_supply = ₿19,591,231 ({{as of|2024|01|06|lc=y}}) |

|||

| footnotes = {{notelist|group=infobox}} |

|||

| supply_limit = ₿21,000,000{{efn|name=supply}} |

|||

| timestamping = [[Proof of work]] (partial hash inversion) |

|||

| issuance_schedule = Decentralized (block reward)<br />Initially ₿50 per block, halved every 210,000 blocks |

|||

| block_time = 10 minutes |

|||

| block_reward = ₿3.125 ({{as of|2024|lc=y}}) |

|||

| exchange_rate = Floating |

|||

| market_cap = <!--A reliable source is required --> |

|||

| using_countries = [[Bitcoin in El Salvador|El Salvador]]<ref name="BTCSVSept7FT">{{cite news |title=El Salvador's dangerous gamble on bitcoin |url=https://www.ft.com/content/c257a925-c864-4495-9149-d8956d786310 |date=7 September 2021 |access-date=7 September 2021 |work=[[Financial Times]] |department=The editorial board |archive-date=7 September 2021 |archive-url=https://web.archive.org/web/20210907081627/https://www.ft.com/content/c257a925-c864-4495-9149-d8956d786310 |url-status=live }}</ref> |

|||

}} |

}} |

||

{{Special characters}} |

{{Special characters}} |

||

'''Bitcoin''' (abbreviation: '''BTC'''; [[Currency symbol|sign]]: '''₿''') is the first [[Decentralized application|decentralized]] [[cryptocurrency]]. [[Node (networking)|Nodes]] in the [[peer-to-peer]] [[bitcoin network]] verify transactions through [[cryptography]] and record them in a public [[distributed ledger]], called a [[blockchain]], without central oversight. [[Consensus (computer science)|Consensus]] between nodes is achieved using a computationally intensive process based on [[proof of work]], called [[bitcoin mining|mining]], that guarantees the security of the bitcoin blockchain. Mining consumes increasing quantities of electricity and has been criticized for [[environmental effects of bitcoin|its environmental effects]].<ref>{{Cite news |last1=Huang |first1=Jon |last2=O’Neill |first2=Claire |last3=Tabuchi |first3=Hiroko |author3-link=Hiroko Tabuchi |date=3 September 2021 |title=Bitcoin Uses More Electricity Than Many Countries. How Is That Possible? |language=en-US |work=The New York Times |url=https://www.nytimes.com/interactive/2021/09/03/climate/bitcoin-carbon-footprint-electricity.html |access-date=26 October 2022 |issn=0362-4331 |archive-date=17 February 2023 |archive-url=https://web.archive.org/web/20230217105559/https://www.nytimes.com/interactive/2021/09/03/climate/bitcoin-carbon-footprint-electricity.html |url-status=live }}</ref> |

|||

Based on a [[free market]] ideology, bitcoin was invented in 2008 by [[Satoshi Nakamoto]], an unknown person.<ref name="whoissn">{{Cite news |last=S. |first=L. |date=2 November 2015 |title=Who is Satoshi Nakamoto? |newspaper=The Economist |url=https://www.economist.com/the-economist-explains/2015/11/02/who-is-satoshi-nakamoto |access-date=21 November 2023 |archive-date=22 November 2020 |archive-url=https://web.archive.org/web/20201122172929/https://www.economist.com/the-economist-explains/2015/11/02/who-is-satoshi-nakamoto |url-status=live }}</ref> Use of bitcoin as a [[currency]] began in 2009,<ref name="NY2011">{{Cite magazine |last=Davis |first=Joshua |date=10 October 2011 |title=The Crypto-Currency: Bitcoin and its mysterious inventor |url=https://www.newyorker.com/magazine/2011/10/10/the-crypto-currency |url-status=live |archive-url=https://web.archive.org/web/20141101014157/http://www.newyorker.com/magazine/2011/10/10/the-crypto-currency |archive-date=1 November 2014 |access-date=31 October 2014 |magazine=[[The New Yorker]]}}</ref> with the release of its [[open-source software|open-source implementation]].<ref name="Antonopoulos2014">{{Cite book |last=Antonopoulos|first= Andreas M. |title=Mastering Bitcoin: Unlocking Digital Crypto-Currencies |year=2014 |publisher=O'Reilly Media |isbn=978-1-4493-7404-4 |author-link=Andreas Antonopoulos}}</ref>{{rp|ch. 1}} In 2021, [[Bitcoin in El Salvador|El Salvador adopted it as legal tender]].<ref name=BTCSVSept7FT/> Bitcoin is currently used more as a [[store of value]] and less as a [[medium of exchange]] or [[unit of account]]. It is mostly seen as an [[investment]] and has been described by many scholars as an [[economic bubble]].<ref name="4Nobels">{{Cite news |last=Wolff-Mann |first=Ethan |date=27 April 2018 |title='Only good for drug dealers': More Nobel prize winners snub bitcoin |work=Yahoo Finance |url=https://finance.yahoo.com/news/good-drug-dealers-nobel-prize-winners-snub-bitcoin-184903784.html |url-status=live |access-date=7 June 2018 |archive-url=https://web.archive.org/web/20180612141128/https://finance.yahoo.com/news/good-drug-dealers-nobel-prize-winners-snub-bitcoin-184903784.html |archive-date=12 June 2018}}</ref> As bitcoin is [[pseudonym]]ous, [[Cryptocurrency and crime|its use by criminals]] has attracted the attention of regulators, leading to [[Legality of cryptocurrency by country or territory|its ban by several countries]] {{as of|2021|lc=yes}}.<ref name=SunYin2019>{{Cite journal |last1=Sun Yin |first1=Hao Hua |last2=Langenheldt |first2=Klaus |last3=Harlev |first3=Mikkel |last4=Mukkamala |first4=Raghava Rao |last5=Vatrapu |first5=Ravi |date=2 January 2019 |title=Regulating Cryptocurrencies: A Supervised Machine Learning Approach to De-Anonymizing the Bitcoin Blockchain |url=https://www.researchgate.net/publication/332118587 |journal=[[Journal of Management Information Systems]] |language=en |volume=36 |issue=1 |page=65 |doi=10.1080/07421222.2018.1550550 |s2cid=132398387 |issn=0742-1222 |access-date=29 November 2023 |archive-date=21 April 2024 |archive-url=https://web.archive.org/web/20240421113631/https://www.researchgate.net/publication/332118587_Regulating_Cryptocurrencies_A_Supervised_Machine_Learning_Approach_to_De-Anonymizing_the_Bitcoin_Blockchain |url-status=live }}</ref> |

|||

'''Bitcoin''' ('''₿''') is the world's first [[cryptocurrency]], a form of electronic cash.<ref name="primer">{{cite web |url = http://mercatus.org/sites/default/files/Brito_BitcoinPrimer.pdf |title = Bitcoin: A Primer for Policymakers |publisher = George Mason University |work = Mercatus Center |year = 2013 |accessdate = 22 October 2013 |author1 = Jerry Brito |author2 = Andrea Castillo |lastauthoramp = yes |deadurl = no |archiveurl = https://web.archive.org/web/20130921060724/http://mercatus.org/sites/default/files/Brito_BitcoinPrimer.pdf |archivedate = 21 September 2013 |df = dmy-all }}</ref>{{rp|3}}<ref name="4Nobels"/> It is the first decentralized [[digital currency]]: the system was designed to work without a [[central bank]] or single administrator.<ref name="primer" />{{rp|1}}<ref name="ieeesurvey" /> Bitcoins are sent from user to user on the [[peer-to-peer]] bitcoin network directly, without the need for intermediaries.<ref name="primer" />{{rp|4,5}} These transactions are verified by network [[Node (networking)|nodes]] through [[cryptography]] and recorded in a public [[distributed ledger]] called a [[#Blockchain|blockchain]]. Bitcoin was invented by an unknown person or group of people using the name [[Satoshi Nakamoto]]<ref name="whoissn">{{cite news |url = https://www.economist.com/blogs/economist-explains/2015/11/economist-explains-1 |title = Who is Satoshi Nakamoto? |last1 = S. |first1 = L. |date = 2 November 2015 |work = The Economist |accessdate = 23 September 2016 |archiveurl = https://web.archive.org/web/20160821154511/http://www.economist.com/blogs/economist-explains/2015/11/economist-explains-1 |archivedate = 21 August 2016 |deadurl = no |publisher = The Economist Newspaper Limited |df = dmy-all }}</ref> and released as [[open-source software]] in 2009.<ref name="NY2011">{{cite web |last = Davis |first = Joshua |title = The Crypto-Currency: Bitcoin and its mysterious inventor |url = http://www.newyorker.com/magazine/2011/10/10/the-crypto-currency |work = The New Yorker |date = 10 October 2011 |accessdate = 31 October 2014 |deadurl = no |archiveurl = https://web.archive.org/web/20141101014157/http://www.newyorker.com/magazine/2011/10/10/the-crypto-currency |archivedate = 1 November 2014 |df = dmy-all }}</ref> |

|||

{{TOC LIMIT|4}} |

|||

Bitcoins are created as a reward for a process known as [[#Mining|mining]]. They can be exchanged for other currencies,<ref>{{cite news |title = What is Bitcoin? |url = http://money.cnn.com/infographic/technology/what-is-bitcoin/ |publisher = CNN Money |accessdate = 16 November 2015 |deadurl = no |archiveurl = https://web.archive.org/web/20151031113913/http://money.cnn.com/infographic/technology/what-is-bitcoin/ |archivedate = 31 October 2015 |df = dmy-all }}</ref> products, and services. Research produced by the [[University of Cambridge]] estimates that in 2017, there were 2.9 to 5.8 million unique users using a cryptocurrency wallet, most of them using bitcoin.<ref name="CU2017">{{cite web |last1 = Hileman |first1 = Garrick |last2 = Rauchs |first2 = Michel |title = Global Cryptocurrency Benchmarking Study |url = https://www.jbs.cam.ac.uk/fileadmin/user_upload/research/centres/alternative-finance/downloads/2017-global-cryptocurrency-benchmarking-study.pdf |publisher = Cambridge University |accessdate = 14 April 2017 |deadurl = no |archiveurl = https://web.archive.org/web/20170410130007/https://www.jbs.cam.ac.uk/fileadmin/user_upload/research/centres/alternative-finance/downloads/2017-global-cryptocurrency-benchmarking-study.pdf |archivedate = 10 April 2017 |df = dmy-all }}</ref> |

|||

==History== |

|||

Many economists and investors consider the bitcoin market to be a bubble. Bitcoin has also been criticized for its use in illegal transactions, its high electricity consumption, price volatility, and thefts from exchanges. |

|||

== Terminology == |

|||

The word ''bitcoin'' was defined in a [[white paper]]<ref name="paper">{{cite web |url = https://bitcoin.org/bitcoin.pdf |title = Bitcoin: A Peer-to-Peer Electronic Cash System |date = 31 October 2008 |publisher = bitcoin.org |accessdate = 28 April 2014 |first = Satoshi |last = Nakamoto |deadurl = no |archiveurl = https://web.archive.org/web/20140320135003/https://bitcoin.org/bitcoin.pdf |archivedate = 20 March 2014 |df = dmy-all }}</ref> published on 31 October 2008.<ref name="ageofcr">{{cite book |last1 = Vigna |first1 = Paul |last2 = Casey |first2 = Michael J. |title = The Age of Cryptocurrency: How Bitcoin and Digital Money Are Challenging the Global Economic Order |date = January 2015 |publisher = St. Martin's Press |location = New York |isbn = 978-1-250-06563-6 |edition = 1 }}</ref> It is a [[Compound (linguistics)|compound]] of the words ''[[bit]]'' and ''[[coin]]''.<ref name=btox>{{cite web |title = bitcoin |url = http://www.oxforddictionaries.com/definition/english/bitcoin |publisher = [[OxfordDictionaries.com]] |accessdate = 28 December 2014 |deadurl = no |archiveurl = https://web.archive.org/web/20150102041748/http://www.oxforddictionaries.com/definition/english/bitcoin |archivedate = 2 January 2015 |df = dmy-all }}</ref> Generally "bitcoin" is not capitalized, in the same manner as "dollar" and "euro" are not capitalized. "Bitcoin", capitalized, may refer to the technology and [[computer network|network]] and "bitcoin", lowercase, to refer to the currency.<ref name="capitalization">{{cite web |url = http://www.newyorker.com/tech/elements/the-bitcoin-boom |title = The Bitcoin Boom |publisher = Condé Nast |work = The New Yorker |date = 2 April 2013 |accessdate = 22 December 2013 |author = Bustillos, Maria |quote = Standards vary, but there seems to be a consensus forming around Bitcoin, capitalized, for the system, the software, and the network it runs on, and bitcoin, lowercase, for the currency itself. |deadurl = no |archiveurl = https://web.archive.org/web/20140727185121/http://www.newyorker.com/tech/elements/the-bitcoin-boom |archivedate = 27 July 2014 |df = dmy-all }}</ref><ref>{{cite news |last = Vigna |first = Paul |title = BitBeat: Is It Bitcoin, or bitcoin? The Orthography of the Cryptography |url = https://blogs.wsj.com/moneybeat/2014/03/14/bitbeat-is-it-bitcoin-or-bitcoin-the-orthography-of-the-cryptography |accessdate = 21 April 2014 |newspaper = [[Wall Street Journal|WSJ]] |date = 3 March 2014 |deadurl = no |archiveurl = https://web.archive.org/web/20140419024119/http://blogs.wsj.com/moneybeat/2014/03/14/bitbeat-is-it-bitcoin-or-bitcoin-the-orthography-of-the-cryptography/ |archivedate = 19 April 2014 |df = dmy-all }}</ref> |

|||

One bitcoin can be subdivided into millibitcoin (mBTC), and satoshi (sat). Named in homage to bitcoin's creator, a ''satoshi'' is the smallest amount within bitcoin representing 0.00000001 bitcoins, one hundred millionth of a bitcoin.<ref name="satoshi unit" /> A ''millibitcoin'' equals 0.001 bitcoins, one thousandth of a bitcoin or 100,000 satoshis.<ref>{{cite news |url = http://edition.cnn.com/2014/06/18/business/bitcoin-your-way-to-a-double-espresso/ |title = Bitcoin your way to a double espresso |publisher = CNN |work = cnn.com |date = 9 July 2014 |accessdate = 23 April 2015 |author1 = Katie Pisa |author2 = Natasha Maguder |lastauthoramp = yes |deadurl = no |archiveurl = https://web.archive.org/web/20150618072429/http://edition.cnn.com/2014/06/18/business/bitcoin-your-way-to-a-double-espresso/ |archivedate = 18 June 2015 |df = dmy-all }}</ref> |

|||

[[Ticker symbol]]s used to represent bitcoin are BTC{{efn|name=BTCcode|{{as of | 2014}}, BTC is a commonly used code. |

|||

It does not conform to [[ISO 4217]] as BT is the country code of Bhutan, and ISO 4217 requires the first letter used in global commodities to be 'X'.}} and XBT.{{efn|name=XBTcode|{{as of | 2014}}, XBT, a code that conforms to ISO 4217 though is not officially part of it, is used by [[Bloomberg L.P.]],<ref>{{cite news |title = Bitcoin Ticker Available On Bloomberg Terminal For Employees |publisher = [[TechCrunch]] |url = https://techcrunch.com/2013/08/09/bitcoin-ticker-available-on-bloomberg-terminal/ |date = 9 August 2013 |author = Romain Dillet |accessdate = 2 November 2014 |deadurl = no |archiveurl = https://web.archive.org/web/20141101232825/http://techcrunch.com/2013/08/09/bitcoin-ticker-available-on-bloomberg-terminal/ |archivedate = 1 November 2014 |df = dmy-all }}</ref> [[CNNMoney]],<ref>{{cite news |title = Bitcoin Composite Quote (XBT) |url = http://money.cnn.com/quote/quote.html?symb=XBT |publisher = CNN |work = CNN Money |accessdate = 2 November 2014 |deadurl = no |archiveurl = https://web.archive.org/web/20141027100208/http://money.cnn.com/quote/quote.html?symb=xbt |archivedate = 27 October 2014 |df = dmy-all }}</ref> and [[xe.com]].<ref>{{cite web |title = XBT – Bitcoin |publisher = xe.com |accessdate = 2 November 2014 |url = http://www.xe.com/currency/xbt-bitcoin? |deadurl = no |archiveurl = https://web.archive.org/web/20141102111801/http://www.xe.com/currency/xbt-bitcoin |archivedate = 2 November 2014 |df = dmy-all }}</ref>}} |

|||

The [[Unicode]] character for bitcoin is ₿.<ref name=btcregs>{{cite web |url = https://www.loc.gov/law/help/bitcoin-survey/regulation-of-bitcoin.pdf |title = Regulation of Bitcoin in Selected Jurisdictions |publisher = The Law Library of Congress, Global Legal Research Center |date = January 2014 |accessdate = 26 August 2014 |deadurl = no |archiveurl = https://web.archive.org/web/20141014012832/http://www.loc.gov/law/help/bitcoin-survey/regulation-of-bitcoin.pdf |archivedate = 14 October 2014 |df = dmy-all }}</ref>{{rp|2}} This was standardized in version 10.0 in June 2017. As with most new symbols, font support is very limited. Typefaces supporting it include Horta. |

|||

==Ideology== |

|||

Bitcoin is seen as having been politically or ideologically motivated starting from the white paper written by Satoshi Nakamoto. There he stated "The root problem with conventional currencies is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust."<ref name="BitIdeo">{{cite news |last1=Feuer |first1=Alan |title=The Bitcoin Ideology |url=https://www.nytimes.com/2013/12/15/sunday-review/the-bitcoin-ideology.html |accessdate=1 July 2018 |publisher=New York Times |date=14 December 2013}}</ref> |

|||

Early bitcoin supporters were considered to be [[libertarian]] or [[anarchist]] trying to remove currency from the control of governments. [[Roger Ver]] said "At first, almost everyone who got involved did so for philosophical reasons. We saw bitcoin as a great idea, as a way to separate money from the state."<ref name="BitIdeo"/> |

|||

Nigel Dodd argues in "The Social Life of Bitcoin" that the essence of the bitcoin ideology is to remove money from social, as well as governmental, control, and that "Bitcoin will succeed as ''money'' to the extent that it fails as an ''ideology''. The currency relies on that which the ideology underpinning it seeks to deny, namely, the dependence of money upon social relations, and upon trust.<ref name="DoddLSE">{{cite web |last1=Dodd |first1=Nigel |title=The social life of Bitcoin |url=http://eprints.lse.ac.uk/69229/1/Dodd_The%20social%20life%20of%20Bitcoin_author_2017%20LSERO.pdf |website=LSE Research Online |accessdate=1 July 2018 |date=2017}}</ref> |

|||

{{external media | width = 210px | float = right | video1 = [https://www.youtube.com/watch?v=XQqZ9b0S0BY The Declaration Of Bitcoin's Independence], BraveTheWorld, 4:38<ref name="DecInd"/>| accessdate =July 1, 2018 }} |

|||

Dodd shows the intensity of the ideological and political motivation for bitcoin by quoting a YouTube video, with Roger Ver, [[Jeff Berwick]], Kristov Atlas, Trace Meyer and other leaders of the bitcoin movement reading ''The Declaration of Bitcoin's Independence.'' The declaration includes the words "Bitcoin is inherently anti-establishment, anti-system, and anti-state. Bitcoin undermines governments and disrupts institutions because bitcoin is fundamentally humanitarian."<ref name="DoddLSE"/><ref name="DecInd">{{cite web |last1=Tourianski |first1=Julia |title=The Declaration Of Bitcoin's Independence |url=https://archive.org/details/DECLARATION_201508 |website=Archive.org |accessdate=1 July 2018}}</ref> |

|||

David Golumbia traces the influences on bitcoin ideology back to right-wing extremists such as the [[Liberty Lobby]] and the [[John Birch Society]] and their anti-Central Bank rhetoric. More recent influences include [[Ron Paul]] and [[Tea Party movement|Tea Party]]-style libertarianism.<ref name="Golumbia1">{{cite book |last1=Golumbia |first1=David |editor1-last=Lovink |editor1-first=Geert |title=Bitcoin as Politics: Distributed Right-Wing Extremism |date=2015 |publisher=Institute of Network Cultures, Amsterdam |isbn=978-90-822345-5-8 |pages=117-131 |url=https://poseidon01.ssrn.com/delivery.php?ID=638096082013126019075001030016090091053039023004022060096115026072001090091017090005100007032007024026014125106070028021015078045005010079051076027087082070020112088028013016000113122083084111125120107068127064026098006121014099115067086085066096065127&EXT=pdf}}</ref> [[Steve Bannon]] who owns a "good stake" in bitcoin, considers it to be "disruptive populism. It takes control back from central authorities. It’s revolutionary."<ref name="NYTBannon">{{cite news |last1=Peters |first1=Jeremy W. |last2=Popper |first2=Nathaniel |title=Stephen Bannon Buys Into Bitcoin |url=https://www.nytimes.com/2018/06/14/technology/steve-bannon-bitcoin.html |accessdate=1 July 2018 |publisher=New York Times |date=14 June 2018}}</ref> |

|||

== History == |

|||

{{Main|History of bitcoin}} |

{{Main|History of bitcoin}} |

||

===Creation=== |

|||

The domain name "bitcoin.org" was registered on 18 August 2008.<ref>{{cite news |last1=Bernard |first1=Zoë |title=Everything you need to know about Bitcoin, its mysterious origins, and the many alleged identities of its creator |url=http://www.businessinsider.com/bitcoin-history-cryptocurrency-satoshi-nakamoto-2017-12 |accessdate=15 June 2018 |work=Business Insider |date=2 December 2017}}</ref> In November 2008, a link to a paper authored by [[Satoshi Nakamoto]] titled ''Bitcoin: A Peer-to-Peer Electronic Cash System''<ref name="paper" /> was posted to a cryptography mailing list. Nakamoto implemented the bitcoin software as [[open source code]] and released it in January 2009.<ref>{{cite web |url = https://sourceforge.net/p/bitcoin/code/HEAD/tree/ |title = Bitcoin |author = Nakamoto, Satoshi |date = 3 January 2009 |deadurl = no |archiveurl = https://web.archive.org/web/20170721190347/https://sourceforge.net/p/bitcoin/code/HEAD/tree/ |archivedate = 21 July 2017 |df = dmy-all }}</ref><ref>{{cite web |url = http://www.mail-archive.com/cryptography@metzdowd.com/msg10142.html |author = Nakamoto, Satoshi |date = 9 January 2009 |title = Bitcoin v0.1 released |archiveurl = https://web.archive.org/web/20140326174921/http://www.mail-archive.com/cryptography%40metzdowd.com/msg10142.html |archivedate = 26 March 2014 |deadurl = no |df = }}</ref><ref name="NY2011" /> The identity of Nakamoto remains unknown.{{r|whoissn}} |

|||

===Background=== |

|||

In January 2009, the bitcoin network was created when Nakamoto mined the first block of the chain, known as the ''genesis block''.<ref name="Wired:RFB">{{cite news |author = Wallace, Benjamin |title = The Rise and Fall of Bitcoin |url = https://www.wired.com/magazine/2011/11/mf_bitcoin/ |publisher = Wired |date = 23 November 2011 |accessdate = 13 October 2012 |archiveurl = https://web.archive.org/web/20131031043919/http://www.wired.com/magazine/2011/11/mf_bitcoin |archivedate = 31 October 2013 |deadurl = no |df = }}</ref><ref>{{cite web |title = Block 0 – Bitcoin Block Explorer |url = http://blockexplorer.com/block/000000000019d6689c085ae165831e934ff763ae46a2a6c172b3f1b60a8ce26f |archiveurl = https://web.archive.org/web/20131015154613/http://blockexplorer.com/block/000000000019d6689c085ae165831e934ff763ae46a2a6c172b3f1b60a8ce26f |archivedate = 15 October 2013 |deadurl = no |df = }}</ref> Embedded in the coinbase of this block was the following text: |

|||

Before bitcoin, several [[digital cash|digital cash technologies]] were released, starting with [[David Chaum]]'s [[ecash]] in the 1980s.<ref name=Narayanan2017/> The idea that solutions to computational puzzles could have some value was first proposed by cryptographers [[Cynthia Dwork]] and [[Moni Naor]] in 1992.<ref name=Narayanan2017/> The concept was [[Multiple discovery|independently rediscovered]] by [[Adam Back]] who developed [[Hashcash]], a [[proof-of-work]] scheme for [[Anti-spam techniques|spam control]] in 1997.<ref name="Narayanan2017" /> The first proposals for distributed digital scarcity-based [[cryptocurrencies]] came from [[cypherpunk]]s [[Wei Dai]] (b-money) and [[Nick Szabo]] ([[bit gold]]) in 1998.<ref>{{Cite journal |last1=Tschorsch |first1=Florian |last2=Scheuermann |first2=Bjorn |date=2 March 2016 |title=Bitcoin and Beyond: A Technical Survey on Decentralized Digital Currencies |url=https://ieeexplore.ieee.org/document/7423672 |journal=IEEE Communications Surveys & Tutorials |volume=18 |issue=3 |pages=2084–2123 |doi=10.1109/COMST.2016.2535718 |s2cid=5115101 |issn=1553-877X |access-date=23 November 2023 |archive-date=19 November 2023 |archive-url=https://web.archive.org/web/20231119025114/http://ieeexplore.ieee.org/document/7423672 |url-status=live }}</ref> In 2004, [[Hal Finney (cypherpunk)|Hal Finney]] developed the first currency based on reusable proof of work.<ref>{{cite book |last1=Judmayer |first1=Aljosha |chapter=History of Cryptographic Currencies |date=2017 |chapter-url=https://link.springer.com/10.1007/978-3-031-02352-1_3 |title=Blocks and Chains |pages=15–18 |publisher=[[Springer Nature|Springer]] |language=en |doi=10.1007/978-3-031-02352-1_3 |isbn=978-3-031-01224-2 |last2=Stifter |first2=Nicholas |last3=Krombholz |first3=Katharina |last4=Weippl |first4=Edgar |series=Synthesis Lectures on Information Security, Privacy, and Trust |url=https://link.springer.com/book/10.1007/978-3-031-02352-1 |access-date=22 November 2023 |archive-date=22 November 2023 |archive-url=https://web.archive.org/web/20231122135006/https://link.springer.com/book/10.1007/978-3-031-02352-1 |url-status=live }}</ref> These various attempts were not successful:<ref name="Narayanan2017" /> Chaum's concept required centralized control and no banks wanted to sign on, Hashcash had no protection against [[double-spending]], while b-money and bit gold were not resistant to [[Sybil attack]]s.<ref name=Narayanan2017>{{Cite journal |last1=Narayanan |first1=Arvind |last2=Clark |first2=Jeremy |date=27 November 2017 |title=Bitcoin's academic pedigree |url=https://queue.acm.org/detail.cfm?id=3136559 |journal=[[Communications of the ACM]] |volume=60 |issue=12 |pages=36–45 |doi=10.1145/3132259 |s2cid=6425116 |issn=0001-0782 |access-date=22 November 2023 |archive-date=14 October 2023 |archive-url=https://web.archive.org/web/20231014120907/https://queue.acm.org/detail.cfm?id=3136559 |url-status=live }}</ref> |

|||

<blockquote>The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.<ref name="NY2011" /></blockquote> |

|||

This note has been interpreted as both a timestamp and a comment on the instability caused by [[fractional-reserve banking]].<ref>{{cite book|last1=Pagliery|first1=Jose|title=Bitcoin: And the Future of Money|date=2014|publisher=Triumph Books|isbn=9781629370361|url=https://books.google.com.au/books?id=_-wuBAAAQBAJ|accessdate=20 January 2018|deadurl=no|archiveurl=https://web.archive.org/web/20180121071329/https://books.google.com.au/books?id=_-wuBAAAQBAJ|archivedate=21 January 2018}}</ref>{{rp|18}} |

|||

===2008–2009: Creation=== |

|||

The receiver of the first bitcoin transaction was [[cypherpunk]] [[Hal Finney (cypherpunk)|Hal Finney]], who created the first [[Proof-of-work system#Reusable proof-of-work as e-money|reusable proof-of-work]] system (RPOW) in 2004.<ref>{{cite web |url=http://www.sfgate.com/technology/businessinsider/article/Here-s-The-Problem-With-The-New-Theory-That-A-4529573.php |title=Here's The Problem with the New Theory That A Japanese Math Professor Is The Inventor of Bitcoin |work=San Francisco Chronicle |accessdate=24 February 2015 |deadurl=no |archiveurl=https://web.archive.org/web/20150104063653/http://www.sfgate.com/technology/businessinsider/article/Here-s-The-Problem-With-The-New-Theory-That-A-4529573.php |archivedate=4 January 2015 |df= }}</ref> Finney downloaded the bitcoin software on its release date, and received 10 bitcoins from Nakamoto.<ref>{{Cite news |url = https://www.washingtonpost.com/blogs/the-switch/wp/2014/01/03/hal-finney-received-the-first-bitcoin-transaction-heres-how-he-describes-it/ |title = Hal Finney received the first Bitcoin transaction. Here's how he describes it. |last = Peterson |first = Andrea |work = The Washington Post |accessdate = |date = 3 January 2014 |deadurl = no |archiveurl = https://web.archive.org/web/20150227213647/http://www.washingtonpost.com/blogs/the-switch/wp/2014/01/03/hal-finney-received-the-first-bitcoin-transaction-heres-how-he-describes-it/ |archivedate = 27 February 2015 |df = dmy-all }}</ref><ref>{{cite news |last1 = Popper |first1 = Nathaniel |title = Hal Finney, Cryptographer and Bitcoin Pioneer, Dies at 58 |url = https://www.nytimes.com/2014/08/31/business/hal-finney-cryptographer-and-bitcoin-pioneer-dies-at-58.html?_r=1 |accessdate = 2 September 2014 |work = NYTimes |date = 30 August 2014 |deadurl = no |archiveurl = https://web.archive.org/web/20140903162835/http://www.nytimes.com/2014/08/31/business/hal-finney-cryptographer-and-bitcoin-pioneer-dies-at-58.html?_r=1 |archivedate = 3 September 2014 |df = dmy-all }}</ref> Other early cypherpunk supporters were creators of bitcoin predecessors: [[Wei Dai]], creator of ''b-money'', and [[Nick Szabo]], creator of ''[[bit gold]]''.<ref name="WallaceWired11">{{cite news |url = https://www.wired.com/magazine/2011/11/mf_bitcoin/ |title = The Rise and Fall of Bitcoin |work = Wired |date = 23 November 2011 |accessdate = 4 November 2013 |author = Wallace, Benjamin |deadurl = no |archiveurl = https://web.archive.org/web/20131104055936/http://www.wired.com/magazine/2011/11/mf_bitcoin/ |archivedate = 4 November 2013 |df = dmy-all }}</ref> |

|||

{{external media |

|||

| float = right |

|||

| width = 258px |

|||

| image1 = [https://www.thetimes03jan2009.com/wp-content/uploads/2015/03/genesis-block-newspaper-bitcoin.jpg Cover page of ''The Times'' 3 January 2009 showing the headline used in the genesis block] |

|||

}} |

|||

{{multiple image |

|||

| width = 90 |

|||

| image1 = Bitcoin old.png |

|||

| image2 = Bitcoin.png |

|||

| footer = Bitcoin logos made by Satoshi Nakamoto in 2009 (left) and 2010 (right) [[Skeuomorph|depict bitcoins]] as [[gold coin|gold tokens]]. |

|||

}} |

|||

The domain name ''bitcoin.org'' was registered on 18 August 2008.<ref>{{Cite news |last=Bernard |first=Zoë |date=2 December 2017 |title=Everything you need to know about Bitcoin, its mysterious origins, and the many alleged identities of its creator |work=Business Insider |url=http://www.businessinsider.com/bitcoin-history-cryptocurrency-satoshi-nakamoto-2017-12 |url-status=live |access-date=15 June 2018 |archive-url=https://web.archive.org/web/20180615010015/http://www.businessinsider.com/bitcoin-history-cryptocurrency-satoshi-nakamoto-2017-12 |archive-date=15 June 2018}}</ref> On 31 October 2008, a link to a [[white paper]] authored by [[Satoshi Nakamoto]] titled ''Bitcoin: A Peer-to-Peer Electronic Cash System'' was posted to a cryptography mailing list.<ref>{{Cite news |last=Finley |first=Klint |date=31 October 2018 |title=After 10 Years, Bitcoin Has Changed Everything—And Nothing |magazine=Wired |url=https://www.wired.com/story/after-10-years-bitcoin-changed-everything-nothing/ |url-status=live |access-date=9 November 2018 |archive-url=https://web.archive.org/web/20181105070656/https://www.wired.com/story/after-10-years-bitcoin-changed-everything-nothing/ |archive-date=5 November 2018}}</ref> Nakamoto implemented the bitcoin software as [[open-source software|open-source code]] and released it in January 2009.<ref name="NY2011" /> Nakamoto's identity remains unknown.{{r|whoissn}} All individual components of bitcoin originated in earlier academic literature.<ref name=Narayanan2017/> Nakamoto's innovation was their complex interplay resulting in the first decentralized, Sybil resistant, [[Byzantine fault]] tolerant digital cash system, that would eventually be referred to as the first blockchain.<ref name=Narayanan2017/><ref name="te20151031">{{Cite news |last=Economist Staff |date=31 October 2015 |title=Blockchains: The great chain of being sure about things |url=https://www.economist.com/news/briefing/21677228-technology-behind-bitcoin-lets-people-who-do-not-know-or-trust-each-other-build-dependable |url-status=live |newspaper=[[The Economist]] |archive-url=https://web.archive.org/web/20160703000844/http://www.economist.com/news/briefing/21677228-technology-behind-bitcoin-lets-people-who-do-not-know-or-trust-each-other-build-dependable |archive-date=3 July 2016 |access-date=18 June 2016 }}</ref> Nakamoto's paper was not [[peer review]]ed and was initially ignored by academics, who argued that it could not work.<ref name=Narayanan2017/> |

|||

On 3 January 2009, the bitcoin network was created when Nakamoto mined the starting block of the chain, known as the ''[[Genesis (blockchain)|genesis block]]''.<ref name="Wired:RFB">{{Cite magazine |last=Wallace, Benjamin |date=23 November 2011 |title=The Rise and Fall of Bitcoin |url=https://www.wired.com/2011/11/mf-bitcoin/ |url-status=live |magazine=Wired |archive-url=https://web.archive.org/web/20131031043919/http://www.wired.com/magazine/2011/11/mf_bitcoin |archive-date=31 October 2013 |access-date=13 October 2012}}</ref> Embedded in this block was the text "The Times 03/Jan/2009 Chancellor on brink of [[2009 United Kingdom bank rescue package|second bailout for banks]]", which is the date and headline of an issue of ''[[The Times]]'' newspaper.<ref name="NY2011" /> Nine days later, Hal Finney received the first bitcoin transaction: ten bitcoins from Nakamoto.<ref>{{Cite news |last=Popper |first=Nathaniel |date=30 August 2014 |title=Hal Finney, Cryptographer and Bitcoin Pioneer, Dies at 58 |work=[[The New York Times]] |url=https://www.nytimes.com/2014/08/31/business/hal-finney-cryptographer-and-bitcoin-pioneer-dies-at-58.html |url-status=live |access-date=2 September 2014 |archive-url=https://web.archive.org/web/20140903162835/http://www.nytimes.com/2014/08/31/business/hal-finney-cryptographer-and-bitcoin-pioneer-dies-at-58.html |archive-date=3 September 2014}}</ref> Wei Dai and Nick Szabo were also early supporters.<ref name="Wired:RFB" /> On May 22, 2010, the first known [[Financial transaction|commercial transaction]] using bitcoin occurred when programmer Laszlo Hanyecz bought two [[Papa John's]] pizzas for ₿10,000, in what would later be celebrated as "Bitcoin Pizza Day".<ref>{{cite news |last1=Cooper |first1=Anderson |title=Meet the man who spent millions worth of bitcoin on pizza |url=https://www.cbsnews.com/news/meet-the-man-who-spent-millions-worth-of-bitcoin-on-pizza-60-minutes-2019-05-16 |work=[[CBS News]] |date=16 May 2019 |access-date=8 December 2021 |archive-date=8 December 2021 |archive-url=https://web.archive.org/web/20211208180706/https://www.cbsnews.com/news/meet-the-man-who-spent-millions-worth-of-bitcoin-on-pizza-60-minutes-2019-05-16/ |url-status=live }}</ref> |

|||

Nakamoto is estimated to have mined 1 million bitcoins.<ref>{{cite news |last1 = McMillan |first1 = Robert |title = Who Owns the World's Biggest Bitcoin Wallet? The FBI |url = https://www.wired.com/2013/12/fbi_wallet/ |accessdate = 7 October 2016 |work = Wired |publisher = Condé Nast |deadurl = no |archiveurl = https://web.archive.org/web/20161021221609/https://www.wired.com/2013/12/fbi_wallet/ |archivedate = 21 October 2016 |df = dmy-all }}</ref> before disappearing in 2010, when he handed the network alert key and control of the [[Bitcoin Core]] code repository over to [[Gavin Andresen]]. Andresen later became lead developer at the [[Bitcoin Foundation]].<ref>{{cite web |last1 = Simonite |first1 = Tom |title = Meet Gavin Andresen, the most powerful person in the world of Bitcoin |url = https://www.technologyreview.com/s/527051/the-man-who-really-built-bitcoin/ |website = MIT Technology Review |accessdate = 6 December 2017 }}</ref><ref name="governance">{{cite news |last1 = Odell |first1 = Matt |title = A Solution To Bitcoin’s Governance Problem |url = https://techcrunch.com/2015/09/21/a-solution-to-bitcoins-governance-problem/ |accessdate = 24 January 2016 |work = TechCrunch |date = 21 September 2015 |deadurl = no |archiveurl = https://web.archive.org/web/20160126051521/http://techcrunch.com/2015/09/21/a-solution-to-bitcoins-governance-problem/ |archivedate = 26 January 2016 |df = dmy-all }}</ref> Andresen then sought to decentralize control. This left opportunity for controversy to develop over the future development path of bitcoin.<ref name="breakingup" /><ref name="governance" /> |

|||

=== |

===2010–2012: Early growth=== |

||

[[Blockchain#Blockchain analysis|Blockchain analysts]] estimate that Nakamoto had mined about one million bitcoins<ref>{{Cite news |last=McMillan |first=Robert |title=Who Owns the World's Biggest Bitcoin Wallet? The FBI |magazine=Wired |url=https://www.wired.com/2013/12/fbi-wallet/ |url-status=live |access-date=7 October 2016 |archive-url=https://web.archive.org/web/20161021221609/https://www.wired.com/2013/12/fbi-wallet/ |archive-date=21 October 2016}}</ref> before disappearing in 2010 when he handed the network alert key and control of the [[Software repository|code repository]] over to [[Gavin Andresen]]. Andresen later became lead developer at the [[Bitcoin Foundation]],<ref>{{cite news |last=Simonite |first=Tom |title=Meet Gavin Andresen, the most powerful person in the world of Bitcoin |date=15 August 2014 |url=https://www.technologyreview.com/2014/08/15/12784/the-man-who-really-built-bitcoin |work=[[MIT Technology Review]] |access-date=22 November 2023 |archive-date=22 November 2023 |archive-url=https://web.archive.org/web/20231122163924/https://www.technologyreview.com/2014/08/15/12784/the-man-who-really-built-bitcoin |url-status=live }}</ref><ref>{{Cite news |last=Odell |first=Matt |date=21 September 2015 |title=A Solution To Bitcoin's Governance Problem |work=TechCrunch |url=https://techcrunch.com/2015/09/21/a-solution-to-bitcoins-governance-problem/ |url-status=live |access-date=24 January 2016 |archive-url=https://web.archive.org/web/20160126051521/http://techcrunch.com/2015/09/21/a-solution-to-bitcoins-governance-problem/ |archive-date=26 January 2016}}</ref> an [[List of bitcoin organizations|organization]] founded in September 2012 to promote bitcoin.<ref>{{Cite news |last=Bustillos |first=Maria |date=1 April 2013 |title=The Bitcoin Boom |magazine=The New Yorker |url=https://www.newyorker.com/tech/elements/the-bitcoin-boom |url-status=live |access-date=30 July 2018 |archive-url=https://web.archive.org/web/20180702064450/https://www.newyorker.com/tech/elements/the-bitcoin-boom |archive-date=2 July 2018}}</ref> |

|||

Prices were extremely volatile in 2011, starting at $0.30 per bitcoin, growing 1,656% for the year to $5.27. Prices rose to $31.50 on June 8, a 10,500% increase from January 1. Within a month the price had crashed to $11.00, a 65% decline. The next month if fell to $7.80, and in another month to $4.77, for an overall 85% decline in the ninety days from the June 8 high.<ref name="BitBubbles">{{cite news |last1=Purcell |first1=Lynn Sebastian |title=Bitcoin Bubbles: A History |url=https://seekingalpha.com/article/4132395-bitcoin-bubbles-history |accessdate=3 July 2018 |publisher=Seeking Alpha |date=17 December 2017}}</ref><ref name="Odata">{{cite web |title=Bitcoin Historical Prices |url=https://www.officialdata.org/bitcoin-price |website=OfficialData.org |accessdate=3 July 2018}}</ref> |

|||

After early "[[proof-of-concept]]" transactions, the first major users of bitcoin were [[black market]]s, such as the [[dark web]] [[Silk Road (marketplace)|Silk Road]]. During its 30 months of existence, beginning in February 2011, Silk Road exclusively accepted bitcoins as payment, transacting ₿9.9 million, worth about $214 million.<ref name=JEP/>{{rp|222}} |

|||

[[Litecoin]] was an early bitcoin spinoff or altcoin, starting in October 2011. Many altcoins have been created since. |

|||

===2013–2014: First regulatory actions=== |

|||

In 2012 bitcoin prices started at $5.27 growing 153% to $13.30 for the year.<ref name="Odata"/> By January 9 the price had risen to $7.38, but then crashed by 49% over the next 16 days. The price then rose to $16.41 on August 17, but fell by 57% over the next three days.<ref name="MktWatch09022018">{{cite news |last1=French |first1=Sally |title=Here’s proof that this bitcoin crash is far from the worst the cryptocurrency has seen |url=https://www.marketwatch.com/story/heres-proof-that-this-bitcoin-crash-is-far-from-the-worst-the-cryptocurrency-has-seen-2018-02-09 |accessdate=3 July 2018 |publisher=Market Watch |date=9 February 2017}}</ref> |

|||

In March 2013, the US [[Financial Crimes Enforcement Network]] (FinCEN) established regulatory guidelines for "decentralized virtual currencies" such as bitcoin, classifying American bitcoin miners who sell their generated bitcoins as [[money services business]]es, subject to registration and other legal obligations.<ref>{{cite news |last=Lee |first=Timothy B. |date=19 March 2013 |title=US regulator Bitcoin Exchanges Must Comply With Money Laundering Laws |url=https://arstechnica.com/tech-policy/2013/03/us-regulator-bitcoin-exchanges-must-comply-with-money-laundering-laws/ |url-status=live |archive-url=https://web.archive.org/web/20131021203745/http://arstechnica.com/tech-policy/2013/03/us-regulator-bitcoin-exchanges-must-comply-with-money-laundering-laws/ |archive-date=21 October 2013 |access-date=28 July 2017 |work=[[Ars Technica]]}}</ref> In May 2013, US authorities seized the unregistered [[Cryptocurrency exchange|exchange]] [[Mt. Gox]].<ref>{{cite news |last=Dillet |first=Romain |title=Feds Seize Assets From Mt. Gox's Dwolla Account, Accuse It Of Violating Money Transfer Regulations |url=https://techcrunch.com/2013/05/16/mt-gox-dwolla-account-money-seizure/ |work=[[TechCrunch]] |url-status=live |archive-url=https://web.archive.org/web/20131009161856/http://techcrunch.com/2013/05/16/mt-gox-dwolla-account-money-seizure/ |archive-date=9 October 2013 |access-date=15 May 2013}}</ref> In June 2013, the US [[Drug Enforcement Administration]] seized ₿11.02 from a man attempting to use them to buy illegal substances. This marked the first time a government agency had seized bitcoins.<ref>{{Cite news |last=Sampson |first=Tim |year=2013 |title=U.S. government makes its first-ever Bitcoin seizure |work=The Daily Dot |url=http://www.dailydot.com/business/11-bitcoins-seized-government-dea/ |url-status=live |access-date=15 October 2013 |archive-url=https://web.archive.org/web/20130712010826/http://www.dailydot.com/business/11-bitcoins-seized-government-dea/ |archive-date=12 July 2013}}</ref> The FBI seized about ₿30,000 in October 2013 from Silk Road, following the arrest of its founder [[Ross Ulbricht]].<ref>{{Cite news |last=Hill |first=Kashmir |title=The FBI's Plan For The Millions Worth Of Bitcoins Seized From Silk Road |work=Forbes |url=https://www.forbes.com/sites/kashmirhill/2013/10/04/fbi-silk-road-bitcoin-seizure/ |url-status=live |archive-url=https://web.archive.org/web/20140502154935/http://www.forbes.com/sites/kashmirhill/2013/10/04/fbi-silk-road-bitcoin-seizure/ |archive-date=2 May 2014}}</ref> |

|||

In December 2013, the [[People's Bank of China]] prohibited Chinese financial institutions from using bitcoin.<ref>{{Cite news |last=Kelion, Leo |date=18 December 2013 |title=Bitcoin sinks after China restricts yuan exchanges |work=BBC News |url=https://www.bbc.co.uk/news/technology-25428866 |url-status=live |access-date=20 December 2013 |archive-url=https://web.archive.org/web/20131219214615/http://www.bbc.co.uk/news/technology-25428866 |archive-date=19 December 2013}}</ref> After the announcement, the value of bitcoin dropped,<ref>{{Cite news |date=6 December 2013 |title=China bans banks from bitcoin transactions |work=[[The Sydney Morning Herald]] |publisher=Reuters |url=https://www.smh.com.au/business/markets/currencies/china-bans-banks-from-bitcoin-transactions-20131206-2yugy.html |url-status=live |access-date=31 October 2014 |archive-url=https://web.archive.org/web/20140323102824/http://www.smh.com.au/business/markets/currencies/china-bans-banks-from-bitcoin-transactions-20131206-2yugy.html |archive-date=23 March 2014}}</ref> and [[Baidu]] no longer accepted bitcoins for certain services.<ref>{{Cite news |date=7 December 2013 |title=Baidu Stops Accepting Bitcoins After China Ban |work=Bloomberg |location=New York |url=https://www.bloomberg.com/news/2013-12-07/baidu-stops-accepting-bitcoins-after-china-ban.html |url-status=live |access-date=11 December 2013 |archive-url=https://web.archive.org/web/20131210214547/http://www.bloomberg.com/news/2013-12-07/baidu-stops-accepting-bitcoins-after-china-ban.html |archive-date=10 December 2013}}</ref> Buying real-world goods with any virtual currency had been illegal in China since at least 2009.<ref>{{cite web |date=29 June 2009 |title=China bars use of virtual money for trading in real goods |url=http://english.mofcom.gov.cn/aarticle/newsrelease/commonnews/200906/20090606364208.html |url-status=live |archive-url=https://web.archive.org/web/20131129184312/http://english.mofcom.gov.cn/aarticle/newsrelease/commonnews/200906/20090606364208.html |archive-date=29 November 2013 |access-date=10 January 2014 |publisher=English.mofcom.gov.cn}}</ref> |

|||

The Bitcoin Foundation was founded in September 2012 to "accelerate the global growth of bitcoin through standardization, protection, and promotion of the open source protocol". The founders included [[Gavin Andresen]] and [[Charlie Shrem]].<ref>{{Cite news|url=https://www.forbes.com/sites/jonmatonis/2012/09/27/bitcoin-foundation-launches-to-drive-bitcoins-advancement/#3fbfe7d1d868|title=Bitcoin Foundation Launches To Drive Bitcoin's Advancement|last=Matonis|first=Jon|work=Forbes|access-date=2017-05-20}}</ref> |

|||

=== |

===2015–2019=== |

||

Research produced by the [[University of Cambridge]] estimated that in 2017, there were 2.9 to 5.8 million unique users using a [[cryptocurrency wallet]], most of them using bitcoin.<ref>{{cite web |last1=Hileman |first1=Garrick |last2=Rauchs |first2=Michel |title=Global Cryptocurrency Benchmarking Study |url=https://www.jbs.cam.ac.uk/fileadmin/user_upload/research/centres/alternative-finance/downloads/2017-global-cryptocurrency-benchmarking-study.pdf |url-status=live |archive-url=https://web.archive.org/web/20170410130007/https://www.jbs.cam.ac.uk/fileadmin/user_upload/research/centres/alternative-finance/downloads/2017-global-cryptocurrency-benchmarking-study.pdf |archive-date=10 April 2017 |access-date=14 April 2017 |publisher=Cambridge University}}</ref> In August 2017, the [[SegWit]] software upgrade was activated. Segwit was intended to support the [[Lightning Network]] as well as improve [[scalability]].<ref>{{Cite news |last=Vigna |first=Paul |date=21 July 2017 |title=Bitcoin Rallies Sharply After Vote Resolves Bitter Scaling Debate |work=The Wall Street Journal |url=https://www.wsj.com/articles/bitcoin-rallies-sharply-after-vote-resolves-bitter-scaling-debate-1500656084 |access-date=21 November 2023 |archive-date=21 November 2023 |archive-url=https://web.archive.org/web/20231121164350/https://www.wsj.com/articles/bitcoin-rallies-sharply-after-vote-resolves-bitter-scaling-debate-1500656084 |url-status=live }}</ref> SegWit opponents, who supported larger blocks as a scalability solution, [[Fork (blockchain)|forked]] to create [[Bitcoin Cash]], one of many [[List of bitcoin forks|forks of bitcoin]].<ref>{{Cite news |last=Selena Larson |date=1 August 2017 |title=Bitcoin split in two, here's what that means |work=CNN Tech |publisher=Cable News Network |url=https://money.cnn.com/2017/08/01/technology/business/bitcoin-cash-new-currency/index.html |url-status=live |access-date=2 April 2018 |archive-url=https://web.archive.org/web/20180227214042/https://money.cnn.com/2017/08/01/technology/business/bitcoin-cash-new-currency/index.html |archive-date=27 February 2018}}</ref> |

|||

In 2013 prices started at $13.30 rising 5,691% to $770 by January 1, 2014.<ref name="Odata"/> |

|||

In December 2017, the first [[futures contract|futures]] on bitcoin was introduced by the [[Chicago Mercantile Exchange]] (CME).<ref>{{Cite web |url=https://www.cnbc.com/2017/12/17/worlds-largest-futures-exchange-set-to-launch-bitcoin-futures-sunday-night.html |title=Bitcoin debuts on the world’s largest futures exchange, and prices fall slightly |date=17 December 2017 |access-date=19 January 2024 |website=CNBC |last=Cheng |first=Evelyn |archive-date=18 January 2024 |archive-url=https://web.archive.org/web/20240118182719/https://www.cnbc.com/2017/12/17/worlds-largest-futures-exchange-set-to-launch-bitcoin-futures-sunday-night.html |url-status=live }}</ref> |

|||

In March 2013 the [[blockchain]] temporarily split into two independent chains with different rules. The two blockchains operated simultaneously for six hours, each with its own version of the transaction history. Normal operation was restored when the majority of the network downgraded to version 0.7 of the bitcoin software.<ref name="bug events">{{cite web |last=Lee |first=Timothy |url=https://arstechnica.com/business/2013/03/major-glitch-in-bitcoin-network-sparks-sell-off-price-temporarily-falls-23/ |title=Major glitch in Bitcoin network sparks sell-off; price temporarily falls 23% |publisher=arstechnica.com |date=11 March 2013 |accessdate=15 February 2015}}</ref> The [[Mt. Gox]] exchange briefly halted bitcoin deposits and the price dropped by 23% to $37<ref name="ArsFork">{{cite web|last=Lee|first=Timothy|title=Major glitch in Bitcoin network sparks sell-off; price temporarily falls 23%|url=https://arstechnica.com/business/2013/03/major-glitch-in-bitcoin-network-sparks-sell-off-price-temporarily-falls-23/|publisher=Arstechnica|date=12 March 2013 | archiveurl = https://www.webcitation.org/6G4e02Xd1 | archivedate = 2013-04-22| deadurl=no}}</ref><ref name="VergeFork">{{cite web|last=Blagdon|first=Jeff|title=Technical problems cause Bitcoin to plummet from record high, Mt. Gox suspends deposits|url=https://www.theverge.com/2013/3/12/4092898/technical-problems-cause-bitcoin-to-plummet-from-record-high|publisher=The Verge|date=12 March 2013 | archiveurl = https://www.webcitation.org/6G4e0aImv | archivedate = 2013-04-22| deadurl=no}}</ref> before recovering to previous level of approximately $48 in the following hours.<ref>{{cite web|title=Bitcoin Charts|url=http://bitcoincharts.com/charts/mtgoxUSD#rg60zczsg2013-03-12zeg2013-03-15ztgSzm1g10zm2g25zv | archiveurl = https://web.archive.org/web/20140509133404/http://bitcoincharts.com/charts/mtgoxUSD | archivedate = 2014-05-09| deadurl=no}}</ref> |

|||

In February 2018, the price crashed after China imposed a complete ban on Bitcoin trading.<ref>{{Cite news |last=French |first=Sally |date=9 February 2017 |title=Here's proof that this bitcoin crash is far from the worst the cryptocurrency has seen |publisher=Market Watch |url=https://www.marketwatch.com/story/heres-proof-that-this-bitcoin-crash-is-far-from-the-worst-the-cryptocurrency-has-seen-2018-02-09 |url-status=live |access-date=3 July 2018 |archive-url=https://web.archive.org/web/20180703220246/https://www.marketwatch.com/story/heres-proof-that-this-bitcoin-crash-is-far-from-the-worst-the-cryptocurrency-has-seen-2018-02-09 |archive-date=3 July 2018}}</ref> The percentage of bitcoin trading in the Chinese [[renminbi]] fell from over 90% in September 2017 to less than 1% in June 2018.<ref>{{Cite news |date=7 July 2018 |title=RMB Bitcoin trading falls below 1 pct of world total |publisher=Xinhuanet |agency=[[Xinhua]] |url=http://www.xinhuanet.com/english/2018-07/07/c_137308879.htm |url-status=live |access-date=10 July 2018 |archive-url=https://web.archive.org/web/20180710225218/http://www.xinhuanet.com/english/2018-07/07/c_137308879.htm |archive-date=10 July 2018}}</ref> During the same year, Bitcoin prices were negatively affected by several hacks or thefts from cryptocurrency exchanges.<ref>{{Cite news |last=Chavez-Dreyfuss |first=Gertrude |date=3 July 2018 |title=Cryptocurrency exchange theft surges in first half of 2018: report |work=Reuters |url=https://www.reuters.com/article/us-crypto-currencies-ciphertrace/cryptocurrency-exchange-theft-surges-in-first-half-of-2018-report-idUSKBN1JT1Q5 |url-status=live |access-date=10 July 2018 |archive-url=https://web.archive.org/web/20180704120854/https://www.reuters.com/article/us-crypto-currencies-ciphertrace/cryptocurrency-exchange-theft-surges-in-first-half-of-2018-report-idUSKBN1JT1Q5 |archive-date=4 July 2018}}</ref> |

|||

The US [[FinCEN|Financial Crimes Enforcement Network (FinCEN)]] established regulatory guidelines for "decentralized virtual currencies" such as bitcoin, classifying American bitcoin miners who sell their generated bitcoins as Money Service Businesses (MSBs), that are subject to registration or other legal obligations.<ref name="ArsFinCEN">{{cite web|last=Lee|first=Timothy|title=US regulator Bitcoin Exchanges Must Comply With Money Laundering Laws|url=https://arstechnica.com/tech-policy/2013/03/us-regulator-bitcoin-exchanges-must-comply-with-money-laundering-laws/|publisher=Arstechnica|date=20 March 2013|quote=Bitcoin miners must also register if they trade in their earnings for dollars. | archiveurl = https://web.archive.org/web/20131021203745/http://arstechnica.com:80/tech-policy/2013/03/us-regulator-bitcoin-exchanges-must-comply-with-money-laundering-laws/ | archivedate = 2013-10-21| deadurl=no}}</ref><ref name="Finextra1">{{cite web|title=US govt clarifies virtual currency regulatory position|url=http://www.finextra.com/News/FullStory.aspx?newsitemid=24645|publisher=Finextra|date=19 March 2013 | archiveurl = https://web.archive.org/web/20140326183202/http://www.finextra.com/News/FullStory.aspx?newsitemid=24645 | archivedate = 2014-03-26| deadurl=no}}</ref><ref name="FinCEN1">{{cite web|title=Application of FinCEN's Regulations to Persons Administering, Exchanging, or Using Virtual Currencies|url=http://www.fincen.gov/statutes_regs/guidance/pdf/FIN-2013-G001.pdf|publisher=Department of the Treasury Financial Crimes Enforcement Network|accessdate=19 March 2013}}</ref> |

|||

===2020–present=== |

|||

In April, payment processors [[BitInstant]] and Mt. Gox experienced processing delays due to insufficient capacity<ref>Roose, Kevin (8 April 2013) {{cite web |url=http://nymag.com/daily/intelligencer/2013/04/inside-the-bitcoin-bubble-bitinstants-ceo.html |title=Inside the Bitcoin Bubble: BitInstant's CEO – Daily Intelligencer | archiveurl = https://web.archive.org/web/20140409031731/http://nymag.com/daily/intelligencer/2013/04/inside-the-bitcoin-bubble-bitinstants-ceo.html | archivedate = 2014-04-09| deadurl=no}}. Nymag.com. Retrieved on 20 April 2013.</ref> resulting in the bitcoin price dropping from $266 to $76 before returning to $160 within six hours.<ref>{{cite web|url=http://bitcoincharts.com/charts/mtgoxUSD|title=Bitcoin Exchange Rate|publisher=Bitcoinscharts.com|accessdate=2013-08-15| archiveurl = https://www.webcitation.org/68eGWrjWE | archivedate = 2012-06-24| deadurl=no}}</ref> |

|||

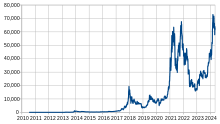

[[File:Bitcoin usd price.svg|thumb|Bitcoin price in US dollars]] |

|||

In 2020, some major companies and institutions started to acquire bitcoin: [[MicroStrategy]] invested $250 million in bitcoin as a [[Treasury management|treasury reserve asset]],<ref>{{Cite news |date=13 September 2021 |title=MicroStrategy buys another $250m worth of bitcoin in hope of 100X price growth |url=https://www.independent.co.uk/tech/microstrategy-bitcoin-crypto-price-prediction-b1919178.html |access-date=22 November 2023 |work=[[The Independent]] |first=Anthony |last=Cuthbertson |language=en |archive-date=22 November 2023 |archive-url=https://web.archive.org/web/20231122163924/https://www.independent.co.uk/tech/microstrategy-bitcoin-crypto-price-prediction-b1919178.html |url-status=live }}</ref> [[Square, Inc.]], $50 million,<ref>{{cite news |author=Oliver Effron |title=Square just bought $50 million in bitcoin |url=https://www.cnn.com/2020/10/08/business/square-bitcoin-crypto-investment/index.html |access-date=22 October 2020 |work=CNN |archive-date=24 October 2020 |archive-url=https://web.archive.org/web/20201024101610/https://www.cnn.com/2020/10/08/business/square-bitcoin-crypto-investment/index.html |url-status=live }}</ref> and [[MassMutual]], $100 million.<ref>{{cite news |url=https://www.bloomberg.com/news/articles/2020-12-10/169-year-old-insurer-massmutual-invests-100-million-in-bitcoin |title=169-Year-Old MassMutual Invests $100 Million in Bitcoin |date=11 December 2020 |work=Bloomberg |access-date=26 December 2020 |author=Olga Kharif |archive-date=19 December 2020 |archive-url=https://web.archive.org/web/20201219220543/https://www.bloomberg.com/news/articles/2020-12-10/169-year-old-insurer-massmutual-invests-100-million-in-bitcoin |url-status=live }}</ref> In November 2020, [[PayPal]] added support for bitcoin in the US.<ref>{{cite news |date=13 November 2020 |title=PayPal says all users in US can now buy, hold and sell cryptocurrencies |url=https://techcrunch.com/2020/11/12/paypal-says-all-users-in-u-s-can-now-buy-hold-and-sell-cryptocurrencies/ |access-date=26 November 2020 |work=Techcrunch |archive-date=24 November 2020 |archive-url=https://web.archive.org/web/20201124050031/https://techcrunch.com/2020/11/12/paypal-says-all-users-in-u-s-can-now-buy-hold-and-sell-cryptocurrencies/ |url-status=live }}</ref> |

|||

In February 2021, Bitcoin's [[market capitalization]] reached $1 trillion for the first time.<ref>{{Cite news |last1=Chavez-Dreyfuss |first1=Gertrude |last2=Wilson |first2=Tom |date=19 February 2021 |title=Bitcoin hits $1 trillion market cap, surges to fresh all-time peak |language=en-US |work=Reuters |url=https://www.reuters.com.article/idUSKBN2AJ0GC/ |access-date=24 November 2023}}</ref> In November 2021, the [[Taproot (fork)|Taproot]] [[soft-fork]] upgrade was activated, adding support for [[Schnorr signature]]s, improved functionality of [[smart contract]]s and [[Lightning Network]].<ref>{{cite news |last=Sigalos |first=MacKenzie |date=14 November 2021 |title=Bitcoin's biggest upgrade in four years just happened – here's what changes |url=https://www.cnbc.com/2021/11/14/bitcoin-taproot-upgrade-what-it-means-for-investors.html |access-date=15 November 2021 |work=CNBC |archive-date=14 November 2021 |archive-url=https://web.archive.org/web/20211114215032/https://www.cnbc.com/2021/11/14/bitcoin-taproot-upgrade-what-it-means-for-investors.html |url-status=live }}</ref> Before, Bitcoin only used a custom [[elliptic curve cryptography|elliptic curve]] with the [[ECDSA]] algorithm to produce [[digital signature|signatures]].<ref>{{Cite book |last1=Van Hijfte |first1=Stijn |title=Blockchain Platforms: A Look at the Underbelly of Distributed Platforms |publisher=Morgan & Claypool Publishers |year=2020 |isbn=978-1681738925}}</ref>{{rp|101}} In September 2021, Bitcoin became [[legal tender]] in [[Bitcoin in El Salvador|El Salvador]], alongside the US dollar.<ref name=BTCSVSept7FT/> In October 2021, the first bitcoin futures [[Exchange-traded fund]] (ETF), called BITO, from [[ProShares]] was approved by the [[U.S. Securities and Exchange Commission|SEC]] and listed on the [[Chicago Mercantile Exchange|CME]].<ref>{{Cite web |url=https://www.wsj.com/articles/a-bitcoin-etf-is-almost-here-what-does-that-mean-for-investors-11634376601 |title=A Bitcoin ETF Is Here. What Does That Mean for Investors? |date=19 October 2021 |access-date=11 January 2024 |website=The Wall Street Journal |last=Wursthorn |first=Michael |url-access=subscription |archive-date=10 January 2024 |archive-url=https://web.archive.org/web/20240110200308/https://www.wsj.com/articles/a-bitcoin-etf-is-almost-here-what-does-that-mean-for-investors-11634376601 |url-status=live }}</ref> |

|||

The bitcoin price rose to $259 on April 10, but then crashed by 83% over the next 3 days.<ref name="MktWatch09022018"/> |

|||

In May and June 2022, the bitcoin price fell following the collapses of [[Terra (blockchain)|TerraUSD]], a [[stablecoin]],<ref>{{cite news|last=Browne|first=Ryan|date=10 May 2022|title=Bitcoin investors are panicking as a controversial crypto experiment unravels|url=https://www.cnbc.com/2022/05/10/bitcoin-btc-investors-panic-as-terrausd-ust-sinks-below-1-peg.html|work=CNBC|access-date=11 May 2022|archive-date=11 May 2022|archive-url=https://web.archive.org/web/20220511021259/https://www.cnbc.com/2022/05/10/bitcoin-btc-investors-panic-as-terrausd-ust-sinks-below-1-peg.html|url-status=live}}</ref> and the [[Celsius Network]], a cryptocurrency loan company.<ref>{{cite news|last1=Milmo|first1=Dan|title=Bitcoin value slumps below $20,000 in cryptocurrencies turmoil|url=https://www.theguardian.com/technology/2022/jun/18/bitcoin-value-falls-cryptocurrency-markets-turmoil|access-date=19 June 2022|work=The Guardian|date=18 June 2022|language=en|archive-date=18 June 2022|archive-url=https://web.archive.org/web/20220618231120/https://www.theguardian.com/technology/2022/jun/18/bitcoin-value-falls-cryptocurrency-markets-turmoil|url-status=live}}</ref><ref>{{cite news|last=Yaffe-Bellany|first=David|date=13 June 2022|title=Celsius Network Leads Crypto Markets Into Another Free Fall|url=https://www.nytimes.com/2022/06/13/technology/bitcoin-ether-price.html|work=The New York Times|access-date=14 June 2022|archive-date=14 June 2022|archive-url=https://web.archive.org/web/20220614030021/https://www.nytimes.com/2022/06/13/technology/bitcoin-ether-price.html|url-status=live}}</ref> |

|||

On 15 May 2013, the US authorities seized accounts associated with Mt. Gox after discovering that it had not registered as a [[money transmitter]] with FinCEN in the US.<ref>{{cite web|last=Dillet|first=Romain|title=Feds Seize Assets From Mt. Gox's Dwolla Account, Accuse It Of Violating Money Transfer Regulations|url=https://techcrunch.com/2013/05/16/mt-gox-dwolla-account-money-seizure/|accessdate=2013-05-15| archiveurl = https://web.archive.org/web/20131009161856/http://techcrunch.com:80/2013/05/16/mt-gox-dwolla-account-money-seizure/ | archivedate = 2013-10-09| deadurl=no}}</ref><ref name="ABA FINCEN">{{cite web |title=Some basic rules for using 'bitcoin' as virtual money |url=http://www.abajournal.com/magazine/article/some_basic_rules_for_using_bitcoin_as_virtual_money/ |publisher=American Bar Association |year=2013 |accessdate=2013-06-26 |last=Berson |first=Susan A.| archiveurl = https://web.archive.org/web/20131029185546/http://www.abajournal.com/magazine/article/some_basic_rules_for_using_bitcoin_as_virtual_money/ | archivedate = 2013-10-29| deadurl=no}}</ref> |

|||

In 2023, ordinals—[[non-fungible token]]s (NFTs)—on Bitcoin, went live.<ref>{{Cite journal |last=Behrendt |first=Philipp |date=2023 |title=Taxation of the New Age: New Guidance for the World of Digital Assets |url=https://heinonline.org/HOL/Page?handle=hein.journals/jtaxpp25&id=105&div=&collection= |journal=Journal of Tax Practice & Procedure |volume=25 |pages=47 |access-date=21 November 2023 |archive-date=21 November 2023 |archive-url=https://web.archive.org/web/20231121164911/https://heinonline.org/HOL/Page?handle=hein.journals/jtaxpp25&id=105&div=&collection= |url-status=live }}</ref> In January 2024, the first 11 US [[spot market|spot]] bitcoin [[exchange-traded fund|ETF]]s began trading, offering direct exposure to bitcoin for the first time on American stock exchanges.<ref>{{Cite news |last=Schmitt |first=Will |date=12 January 2024 |title=Bitcoin trading volumes surge after debut of long-awaited US ETFs |url=https://www.ft.com/content/f30ece62-0f1c-492a-8ccd-63ec9730573c |access-date=12 January 2024 |work=Financial Times |archive-date=12 January 2024 |archive-url=https://web.archive.org/web/20240112025105/https://www.ft.com/content/f30ece62-0f1c-492a-8ccd-63ec9730573c |url-status=live }}</ref><ref>{{cite news|last1=Lang|first1=Hannah|title=US bitcoin ETFs see $4.6B in volume in first day of trading|url=https://www.reuters.com/technology/spot-bitcoin-etfs-start-trading-big-boost-crypto-industry-2024-01-11/|access-date=12 January 2024|work=Reuters|date=11 January 2024|language=en}}</ref> As of June 2023 River Financial estimated that Bitcoin had 81.7 million users, about 1% of the global population.<ref>{{cite web |title=As banks buy up bitcoins, who else are the 'Bitcoin whales'? |website=BBC Home |date=2024-03-01 |url=https://www.bbc.com/news/technology-68434579 |access-date=2024-03-14}}</ref> |

|||

On 23 June 2013, the US [[Drug Enforcement Administration]] listed 11.02 bitcoins as a seized asset in a [[United States Department of Justice]] seizure notice pursuant to 21 U.S.C. § 881.<ref>{{cite web|last=Cohen|first=Brian|title=Users Bitcoins Seized by DEA|url=http://letstalkbitcoin.com/users-bitcoins-seized-by-dea/|accessdate=2013-10-14| archiveurl = https://web.archive.org/web/20131009062454/http://letstalkbitcoin.com:80/users-bitcoins-seized-by-dea/ | archivedate = 2013-10-09| deadurl=no}}</ref> This marked the first time a government agency seized bitcoin.<ref>{{cite web|publisher=El Cuerpo Nacional de Policía|title=The National Police completes the second phase of the operation "Ransomware"|url=https://translate.google.com/translate?sl=es&tl=en&js=n&prev=_t&hl=en&ie=UTF-8&u=http%3A%2F%2Fwww.policia.es%2Fprensa%2F20130927_1.html|accessdate=2013-10-14}}</ref><ref>{{cite web |

|||

|title=U.S. government makes its first-ever Bitcoin seizure|url=http://www.dailydot.com/business/11-bitcoins-seized-government-dea/ |publisher=The Daily Dot |year=2013 |accessdate=2013-10-15 |last=Sampson |first=Tim| archiveurl = https://www.webcitation.org/6Hl0y7teb |archivedate = 2013-06-30| deadurl=no}}</ref> |

|||

==Design== |

|||

The FBI seized about 26,000 bitcoins in October 2013 from darknet website [[Silk Road (marketplace)|Silk Road]] during the arrest of [[Ross William Ulbricht]].<ref>{{cite web|title=After Silk Road seizure, FBI Bitcoin wallet identified and pranked|url=http://www.zdnet.com/after-silk-road-seizure-fbi-bitcoin-wallet-identified-and-pranked-7000021603/| archiveurl = https://web.archive.org/web/20140405173339/http://www.zdnet.com/after-silk-road-seizure-fbi-bitcoin-wallet-identified-and-pranked-7000021603/ | archivedate = 2014-04-05| deadurl=no}}</ref><ref>{{cite web|url=http://blockchain.info/address/1F1tAaz5x1HUXrCNLbtMDqcw6o5GNn4xqX|title=Silkroad Seized Coins| archiveurl = https://www.webcitation.org/6MUFj8Kcn | archivedate = 2014-01-09| deadurl=no}}</ref><ref>{{cite news|url=https://www.forbes.com/sites/kashmirhill/2013/10/04/fbi-silk-road-bitcoin-seizure/|title=The FBI's Plan For The Millions Worth Of Bitcoins Seized From Silk Road | work=Forbes | first=Kashmir|last=Hill| archiveurl = https://web.archive.org/web/20140502154935/http://www.forbes.com/sites/kashmirhill/2013/10/04/fbi-silk-road-bitcoin-seizure/ | archivedate = 2014-05-02| deadurl=no}}</ref> |

|||

{{Main|Bitcoin protocol}} |

|||

===Units and divisibility=== |

|||

Bitcoin's price rose to $755 on 19 November and crashed by 50% to $378 the same day. On 30 November 2013 the price reached $1,163 before starting a long-term crash, declining by 87% to $152 in January 2015.<ref name="MktWatch09022018"/> |

|||

The [[unit of account]] of the bitcoin system is the ''bitcoin''. It is most commonly represented with the [[currency symbol|symbol]] ₿<ref name="unicode-10" /> and the [[currency code]] BTC. However, the BTC code does not conform to [[ISO 4217]] as BT is the country code of Bhutan,<ref name="ssrn.3383734">{{Cite journal |last=Alexander |first=Carol |last2=Imeraj |first2=Arben |date=2019 |title=Introducing the BITIX: The Bitcoin Fear Gauge |url=https://www.ssrn.com/abstract=3383734 |journal=[[SSRN Electronic Journal]] |language=en |doi=10.2139/ssrn.3383734 |issn=1556-5068|quote=XBT satisfies the norm ‘ISO 4217’ by the International Organisation for Standardisation (ISO) as BTC goes against the name of Bhutan’s currency. In general, transaction instruments that are not national currencies, like gold or silver, begin with an X. However, the symbol XBT is not officially recognised by ISO.}}</ref> and ISO 4217 requires the first letter used in global commodities to be 'X'.<ref name="ssrn.3383734"/> XBT, a code that conforms to [[ISO 4217]] though not officially part of it,<ref name="ssrn.3383734"/> is used by [[Bloomberg L.P.]]<ref>{{Cite news |last=Romain Dillet |date=9 August 2013 |title=Bitcoin Ticker Available On Bloomberg Terminal For Employees |work=[[TechCrunch]] |url=https://techcrunch.com/2013/08/09/bitcoin-ticker-available-on-bloomberg-terminal/ |url-status=live |access-date=2 November 2014 |archive-url=https://web.archive.org/web/20141101232825/http://techcrunch.com/2013/08/09/bitcoin-ticker-available-on-bloomberg-terminal/ |archive-date=1 November 2014}}</ref> |

|||

No uniform [[capitalization]] convention exists; some sources use ''Bitcoin'', capitalized, to refer to the technology and [[computer network|network]], and ''bitcoin'', lowercase, for the unit of account.<ref>{{Cite magazine |last=Bustillos, Maria |date=2 April 2013 |title=The Bitcoin Boom |url=https://www.newyorker.com/tech/elements/the-bitcoin-boom |url-status=live |magazine=[[The New Yorker]] |archive-url=https://web.archive.org/web/20140727185121/http://www.newyorker.com/tech/elements/the-bitcoin-boom |archive-date=27 July 2014 |access-date=22 December 2013}}</ref> The ''[[Cambridge Advanced Learner's Dictionary]]'' and the ''[[Oxford Advanced Learner's Dictionary]]'' use the capitalized and lowercase variants without distinction.<ref>[https://www.oxfordlearnersdictionaries.com/definition/english/bitcointm?q=bitcoin Bitcoin], ''[[Oxford Advanced Learner's Dictionary]]''</ref><ref>[https://dictionary.cambridge.org/dictionary/english/bitcoin bitcoin] {{Webarchive|url=https://web.archive.org/web/20220503092252/http://dictionary.cambridge.org/dictionary/english/bitcoin |date=3 May 2022 }}, ''[[Cambridge Advanced Learner's Dictionary]]''</ref> |

|||

On 5 December 2013, the [[People's Bank of China]] prohibited Chinese financial institutions from using bitcoins.<ref name="ccontrols">{{cite news |url=http://www.bbc.co.uk/news/technology-25428866 |title=Bitcoin sinks after China restricts yuan exchanges |publisher=BBC |work=bbc.com |date=18 December 2013 |accessdate=20 December 2013 |author=Kelion, Leo}}</ref> After the announcement, the value of bitcoins dropped,<ref>{{cite news |date=6 December 2013 |url=http://www.smh.com.au/business/markets/currencies/china-bans-banks-from-bitcoin-transactions-20131206-2yugy.html |title=China bans banks from bitcoin transactions |work=[[The Sydney Morning Herald]] |publisher=Reuters |accessdate=31 October 2014}}</ref> and Baidu no longer accepted bitcoins for certain services.<ref name="bloomberg">{{cite news |url=https://www.bloomberg.com/news/2013-12-07/baidu-stops-accepting-bitcoins-after-china-ban.html |title=Baidu Stops Accepting Bitcoins After China Ban |work=Bloomberg |location=New York |date=7 December 2013 |accessdate=11 December 2013}}</ref> Buying real-world goods with any virtual currency had been illegal in China since at least 2009.<ref>{{cite web |url=http://english.mofcom.gov.cn/aarticle/newsrelease/commonnews/200906/20090606364208.html |title=China bars use of virtual money for trading in real goods |publisher=English.mofcom.gov.cn |date=29 June 2009 |accessdate=10 January 2014}}</ref> |

|||