| File:BP Logo.svg | |

| Company type | Public limited company (LSE: BP, NYSE: BP) |

|---|---|

| ISIN | DE0008618737 |

| Industry | Oil and natural gas, alternative fuels |

| Founded | 1909 (as the Anglo-Persian Oil Company) 1954 (as the British Petroleum Company) 1998 (merger of British Petroleum and Amoco) |

| Headquarters | London, United Kingdom |

Area served | Worldwide |

Key people | Carl-Henric Svanberg (Chairman) Bob Dudley (CEO) Byron Grote (CFO)[1] |

| Products | BP petroleum and derived products BP service stations Air BP Aviation Fuels Castrol motor oil ARCO gas stations am/pm convenience stores Aral service stations solar panels |

| Revenue | US $246.1 billion (2009)[2] |

| US $26.43 billion (2009)[2] | |

| US $16.58 billion (2009)[2] | |

| Total assets | US $236.0 billion (2009) |

| Total equity | US $101.6 billion (2009) |

Number of employees | 80,300 (Dec 2009)[3] |

| Website | BP.com |

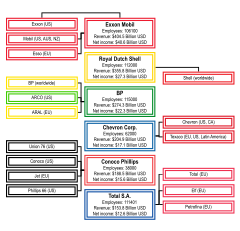

BP p.l.c.[4][5] (LSE: BP, NYSE: BP) is a global oil and gas company headquartered in London, United Kingdom. It is the third largest energy company and the fourth largest company in the world measured by revenues and is one of the six oil and gas "supermajors".[6][7]

It has operations in over 80 countries, produces around 3.8 million barrels of oil equivalent per day and has 22,400 service stations worldwide.[8][9] Its largest division is BP America, which is the biggest producer of oil and gas in the United States and is headquartered in Houston, Texas.[10][11][12] The name "BP" derives from the initials of one of the company's former legal names, British Petroleum.[13][14]

BP has been involved in a number of environmental, safety and political controversies during its history, including the 1965 Sea Gem incident and the 2010 Deepwater Horizon oil spill.

Its primary listing is on the London Stock Exchange and it is a constituent of the FTSE 100 Index. It has a secondary listing on the New York Stock Exchange.

History

Activity in 1909–1979

In May 1901, William Knox D'Arcy was granted a concession by the Shah of Iran to search for oil, which he discovered in May 1908.[15] This was the first commercially significant find in the Middle East. On 14 April 1909, the Anglo-Persian Oil Company (APOC) was incorporated as a subsidiary of Burmah Oil Company to exploit this.[15] In 1935, it became the Anglo-Iranian Oil Company (AIOC).[15]

After World War II, AIOC and the Iranian government initially resisted nationalist pressure to revise AIOC's concession terms still further in Iran's favour. But in March 1951, the pro-western Prime Minister Ali Razmara was assassinated.[16] The Majlis of Iran (parliament) elected a nationalist, Mohammed Mossadeq, as prime minister. In April, the Majlis nationalised the oil industry by unanimous vote.[17] The National Iranian Oil Company was formed as a result, displacing the AIOC.[18] The AIOC withdrew its management from Iran, and organised an effective boycott of Iranian oil. The British government – which owned the AIOC – contested the nationalisation at the International Court of Justice at The Hague, but its complaint was dismissed.[19]

By spring of 1953, incoming U.S. President Dwight D. Eisenhower authorised the Central Intelligence Agency (CIA) to organise a coup against the Mossadeq government with support from the British government.[20] On 19 August 1953, Mossadeq was forced from office by the CIA conspiracy, involving the Shah and the Iranian military, and known by its codename, Operation Ajax.[20]

Mossadeq was replaced by pro-Western general Fazlollah Zahedi[21] and the Shah, who returned to Iran after having left the country briefly to await the outcome of the coup. The Shah abolished the democratic Constitution and assumed autocratic powers.

After the coup, Mossadeq's National Iranian Oil Company became an international consortium, and AIOC resumed operations in Iran as a member of it.[18] The consortium agreed to share profits on a 50–50 basis with Iran, "but not to open its books to Iranian auditors or to allow Iranians onto its board of directors."[22] AIOC, as a part of the Anglo-American coup d'état deal, was not allowed to monopolise Iranian oil as before. It was limited to a 40% share in a new international consortium. For the rest, 40% went to the five major American companies and 20% went to Royal Dutch Shell and Compagnie Française des Pétroles, now Total S.A..[23]

The AIOC became the British Petroleum Company in 1954. In 1959 the company expanded beyond the Middle East to Alaska[24] and in 1965 it was the first company to strike oil in the North Sea.[25] In 1978 the company acquired a controlling interest in Standard Oil of Ohio or Sohio, a breakoff of the former Standard Oil that had been broken up after anti-trust litigation.[26]

It continued to operate in Iran until the Islamic Revolution in 1979. The new regime of Ayatollah Khomeini confiscated all of the company’s assets in Iran without compensation, bringing to an end its 70-year presence in Iran.

1980s and 1990s

Sir Peter Walters was the company chairman from 1981 to 1990.[27] This was the era of the Thatcher government's privatisation strategy. The British government sold its entire holding in the company in several tranches between 1979 and 1987.[28] The sale process was marked by an attempt by the Kuwait Investment Authority, the investment arm of the Kuwait government, to acquire control of the company.[29] This was ultimately blocked by the strong opposition of the British government. In 1987, British Petroleum negotiated the acquisition of Britoil[30] and the remaining publicly traded shares of Standard Oil of Ohio.[26]

Walters was replaced by Robert Horton in 1989. Horton carried out a major corporate down-sizing exercise removing various tiers of management at the Head Office.[31]

Standard Oil of California and Gulf Oil merged in 1984, the largest merger in history at that time. Under the antitrust regulation, SoCal divested many of Gulf's operating subsidiaries, and sold some Gulf stations and a refinery in the eastern United States.[32] British Petroleum bought many of the stations in the Southeastern United States.[citation needed]

John Browne, who had been on the board as managing director since 1991, was appointed group chief executive in 1995.[33] Browne was responsible for three major acquisitions; Amoco, ARCO and Burmah-Castrol (see below).

21st century

British Petroleum merged with Amoco (formerly Standard Oil of Indiana) in December 1998,[34] becoming BP Amoco plc.[35] In 2000, BP Amoco acquired Arco (Atlantic Richfield Co.)[36] and Burmah Castrol plc.[37] As part of the merger's brand awareness, helped the Tate Modern British Art launch RePresenting Britain 1500-2000[38] In 2001 the company formally renamed itself as BP plc[35] and adopted the tagline "Beyond Petroleum," which remains in use today. It states that BP was never meant to be an abbreviation of its tagline. Most Amoco stations in the United States were converted to BP's brand and corporate identity. In many states, however, BP continued to sell Amoco branded petrol even in service stations with the BP identity as Amoco was rated the best petroleum brand by consumers for 16 consecutive years and also enjoyed one of the three highest brand loyalty reputations for petrol in the US, comparable only to Chevron and Shell. In May 2008, when the Amoco name was mostly phased out in favour of "BP Gasoline with Invigorate", promoting BP's new additive, the highest grade of BP petrol available in the United States was still called Amoco Ultimate.

In April 2004, BP decided to move most of its petrochemical businesses into a separate entity called Innovene within the BP Group. BP sought to sell the new company possibly via an initial public offering (IPO) in the US, and filed IPO plans for Innovene with the New York Stock Exchange on 12 September 2005. On 7 October 2005, however, BP announced that it had agreed to sell Innovene to INEOS, a privately held UK chemical company for $9 billion, thereby scrapping its plans for the IPO.[39]

In 2005, BP announced that it would be leaving the Colorado market.[40] Many locations were re-branded as Conoco.[41]

In 2006, when Chevron Corporation gave exclusive rights to the Texaco brand name in the U.S. Texaco sold most of the BP gas stations in the southeast. BP has recently looked to grow its oil exploration activities in frontier areas such as the former Soviet Union for its future reserves.[42] In Russia, BP owns 50% of TNK-BP with the other half owned by three Russian billionaires. TNK-BP accounts for a fifth of BP's global reserves, a quarter of BP's production, and nearly a tenth of its global profits.[43]

In 2007, BP sold its corporate-owned convenience stores, typically known as "BP Connect", to local franchisees and jobbers.[44]

On 12 January 2007, it was announced that Lord Browne would retire as chief executive at the end of July 2007.[45] The new Chief Executive, Tony Hayward, had been head of exploration and production. It had been expected that Lord Browne would retire in February 2008 when he reached the age of 60, the standard retirement age at BP. Browne resigned abruptly from BP on 1 May 2007, following the lifting of a legal injunction preventing Associated Newspapers from publishing details about his private life. Hayward succeeded Browne with immediate effect.[46]

On 1 April 2010, Chevron purchased some BP gas stations in Mississippi and changed them to the Texaco brand.[citation needed]

On July 27, 2010, BP confirmed that Bob Dudley would replace Tony Hayward as the company's CEO.[47]

Corporate Structure

Governance

The Board Members are:[48]

- Carl-Henric Svanberg – Chairman

- Byron Grote – Chief Financial Officer

- Andy Inglis – Chief executive, Exploration and Production

- Antony Burgmans – Non-executive director, board of Mauritshuis, AEGON, Unilever

- Cynthia Carroll – Non-executive director, CEO of Anglo American, also board of De Beers

- Sir William Castell – Non-executive director chairman of The Prince’s Trust

- Paul Anderson – Non-executive director

- Robert Dudley – CEO (as of October 1, 2010)

- Iain Conn

- George David vice-chairman of the Peterson Institute for International Economics

- Ian Davis – Non-executive director

- Douglas Flint, CBE director HSBC

- Dr DeAnne Julius, director of Chatham House

- David Jackson, company secretary

Financial data

| Year | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 |

|---|---|---|---|---|---|---|---|---|

| Sales | 180,186 | 236,045 | 294,849 | 249,465 | 265,906 | 284,365 | 361,341 | 239,272 |

| EBITDA | 22,941 | 28,200 | 37,825 | 41,453 | 44,835 | |||

| Net Results | 6,845 | 10,267 | 15,961 | 22,341 | 22,000 | 20,845 | 21,157 | 16,578 |

| Net Debt | 20,273 | 20,193 | 21,607 | 16,202 | 16,202 |

- Source :OpesC

Environmental record

BP was named by Mother Jones Magazine, an investigative journal that "exposes the evils of the corporate world, the government, and the mainstream media",[49] as one of the ten worst corporations in both 2001 and 2005 based on its environmental and human rights records.[50][51] In 1991 BP was cited as the most polluting company in the US based on EPA toxic release data. BP has been charged with burning polluted gases at its Ohio refinery (for which it was fined $1.7 million), and in July 2000 BP paid a $10 million fine to the EPA for its management of its US refineries.[52] According to PIRG research, between January 1997 and March 1998, BP was responsible for 104 oil spills.[53] BP patented the Dracone Barge to aid in oil spill clean-ups across the world.[54]

As of 11 February 2007 BP announced that they would spend $8 billion over ten years to research alternative methods of fuel, including natural gas, hydrogen, solar, and wind. A $500 million grant to the University of California, Berkeley, Lawrence Berkeley National Laboratory, and the University of Illinois at Urbana-Champaign, to create an Energy Biosciences Institute[55] has recently come under attack, over concerns about the global impacts of the research and privatisation of public universities.[56]

BP's investment in green technologies peaked at 4% of its exploratory budget, but they have since closed their alternative energy headquarters in London. As such they invest more than other oil companies, but it has been called greenwashing due to the small proportion of the overall budget.[57]

In 2004, BP began marketing low-sulphur diesel fuel for industrial use.

BP Solar is a leading producer of solar panels since its purchase of Lucas Energy Systems in 1980 and Solarex (as part of its acquisition of Amoco) in 2000. BP Solar had a 20% world market share in photovoltaic panels in 2004 when it had a capacity to produce 90 MW/year of panels. It has over 30 years' experience operating in over 160 countries with manufacturing facilities in the U.S., Spain, India and Australia, and has more than 2000 employees worldwide. BP has closed its US plants in Frederick, Maryland as part of a transition to manufacturing in China. This is due in part to China's upswing in solar use and the protectionist laws that require 85% of the materials to be produced in China.[58] Through a series of acquisitions in the solar power industry BP Solar became the third largest producer of solar panels in the world. It was recently announced that BP has obtained a contract for a pilot project to provide on-site solar power to Wal-Mart stores.[59] In the 2006 annual report Lord Browne noted that BP now has a total wind generation capacity of nearly 15,000 megawatts. 15,000 megawatts would be sufficient to provide power to approximately 15,000,000 typical American households simultaneously. This makes BP one of the largest generators of wind power in the world.[citation needed]

Climate change

BP Amoco was a member of the Global Climate Coalition an industry organisation established to promote global warming scepticism but withdrew in 1997, saying "the time to consider the policy dimensions of climate change is not when the link between greenhouse gases and climate change is conclusively proven, but when the possibility cannot be discounted and is taken seriously by the society of which we are part. We in BP have reached that point.".[60]

In March 2002 Lord Browne of Madingley declared in a speech that global warming was real and that urgent action was needed, saying that "Companies composed of highly skilled and trained people can't live in denial of mounting evidence gathered by hundreds of the most reputable scientists in the world."[61]

BP is a sponsor of the Scripps Institution CO2 program to measure carbon dioxide levels in the atmosphere.[62]

1993–1995: Hazardous substance dumping

In September 1999, one of BP’s US subsidiaries, BP Exploration Alaska (BPXA), agreed to resolve charges related to the illegal dumping of hazardous wastes on the Alaska North Slope, for $22 million. The settlement included the maximum $500,000 criminal fine, $6.5 million in civil penalties, and BP’s establishment of a $15 million environmental management system at all of BP facilities in the US and Gulf of Mexico that are engaged in oil exploration, drilling or production. The charges stemmed from the 1993 to 1995 dumping of hazardous wastes on Endicott Island, Alaska by BP’s contractor Doyon Drilling. The firm illegally discharged waste oil, paint thinner and other toxic and hazardous substances by injecting them down the outer rim, or annuli, of the oil wells. BPXA failed to report the illegal injections when it learned of the conduct, in violation of the Comprehensive Environmental Response, Compensation and Liability Act.[63]

2006–2007: Prudhoe Bay

In August 2006, BP shut down oil operations in Prudhoe Bay, Alaska, due to corrosion in pipelines leading up to the Alaska Pipeline. The wells were leaking insulating agent called Arctic pack, consisting of crude oil and diesel fuel, between the wells and ice.[64] BP had spilled over one million litres of oil in Alaska's North Slope.[65] This corrosion is caused by sediment collecting in the bottom of the pipe, protecting corrosive bacteria from chemicals sent through the pipeline to fight these bacteria. There are estimates that about 5,000 barrels (790 m3) of oil were released from the pipeline. To date 1,513 barrels (240.5 m3) of liquids, about 5,200 cubic yards (4,000 m3) of soiled snow and 328 cubic yards (251 m3) of soiled gravel have been recovered. After approval from the DOT, only the eastern portion of the field was shut down, resulting in a reduction of 200,000 barrels per day (32,000 m3/d) until work began to bring the eastern field to full production on 2 October 2006.[66]

In May 2007, the company announced another partial field shutdown owing to leaks of water at a separation plant. Their action was interpreted as another example of fallout from a decision to cut maintenance of the pipeline and associated facilities.[67]

On 16 October 2007 Alaska Department of Environmental Conservation officials reported a toxic spill of methanol (methyl alcohol) at the Prudhoe Bay oil field managed by BP PLC. Nearly 2,000 gallons of mostly methanol, mixed with some crude oil and water, spilled onto a frozen tundra pond as well as a gravel pad from a pipeline. Methanol, which is poisonous to plants and animals, is used to clear ice from the insides of the Arctic-based pipelines.[68]

2010: Texas City chemical leak

Two weeks prior to the Deepwater Horizon explosion BP admitted that malfunctioning equipment lead to the release of over 530,000 lbs of chemicals into the air of Texas City and surrounding areas from April 6 to May 16. The leak included 17,000 pounds of benzene (a known carcinogen), 37,000 pounds of nitrogen oxides (which contribute to respiratory problems), and 186,000 pounds of carbon monoxide.[69][70]

2010: Deepwater Horizon oil spill

On 20 April 2010, the semi-submersible exploratory offshore drilling rig Deepwater Horizon exploded after a blowout; it sank two days later, killing 11 people. This blowout in the Macondo Prospect field in the Gulf of Mexico resulted in a partially capped oil well one mile below the surface of the water. Experts estimate the gusher to be flowing at 35,000 to 60,000 barrels per day (5,600 to 9,500 m3/d) of oil.[71][72][73] The exact flow rate is uncertain due to the difficulty of installing measurement devices at that depth and is a matter of ongoing debate.[74] The resulting oil slick covers at least 2,500 square miles (6,500 km2), fluctuating from day to day depending on weather conditions.[75] It threatens the coasts of Louisiana, Mississippi, Alabama, Texas, and Florida.

The drilling rig was owned and operated by Transocean Ltd [76] on behalf of BP, which is the majority owner of the Macondo oil field. At the time of the explosion, there were 126 crew on board; seven were employees of BP and 79 of Transocean. There were also employees of various other companies involved in the drilling operation, including Anadarko, Halliburton and M-I Swaco.[77]

The U.S. Government has named BP the responsible party, and officials have committed to hold the company accountable for all cleanup costs and other damage.[78][79] BP has stated that it would harness all of its resources to battle the oil spill, spending $7 million a day with its partners to try to contain the disaster.[80] In comparison, BP's 1st quarter profits for 2010 were approximately $61 million per day.[81] BP has agreed to create a $20 billion spill response fund administered by Kenneth Feinberg.[82][83][84] The amount of this fund is not a cap or a floor on BP's liabilities. BP will pay $3 billion in third quarter of 2010 and $2 billion in fourth quarter into the fund followed by a payment of $1.25 billion per quarter until it reaches $20 billion. In the interim, BP posts its US assets worth $20 billion as bond. For the fund's payments, BP will cut its capital spending budget, sell $10 billion in assets, and drop its dividend.[82][85] BP has also been targeted in litigation over the claims process it put in place for victims. A class action lawsuit was filed against BP and its initial claims administrator, the ACE, Ltd. Insurance Group company ESIS.[86]

BP began testing the tighter-fitted cap designed to stop the flow of oil into the Gulf of Mexico from a broken well for the first time in almost three months.[87] The test began Wednesday, July 14 with BP shutting off pipes that were funnelling some of the oil to ships on the surface, so the full force of the gusher went up into the cap.[87] Then deep-sea robots began slowly closing — one at a time — three openings in the cap that let oil pass through.[87] Ultimately, the flow of crude was stopped.[87] All along, engineers were and still are watching pressure readings to learn whether the well is intact.[87] Former coast guard admiral Thad Allen, the Obama administration's point man on the disaster, said the government gave the testing go-ahead after carefully reviewing the risks.[87] "What we didn't want to do is compound that problem by making an irreversible mistake," he said.[87]

Stock decline and takeover speculations

After the Deepwater Horizon Oil Spill BP's stock fell by 52% in 50 days on the New York Stock Exchange, going from $60.57 on 20 April 2010, to $29.20 on June 9, its lowest level since August 1996.

Approximately 40% of BP shares are held by UK shareholders, and 39% in the USA.[88] BP's UK dividends represent approximately one-seventh of all dividend payments in the UK and form the basis of many pension schemes.

Some market commentators suggested BP may have to cut its dividend,[89] be broken up,[90] file for bankruptcy or be taken over by another oil company[91] as a result of the spill and associated liabilities.[92][93] Financial analysts suggests 4 possible scenarios. One is that the oil leak stops, political pressure abates, and the cleanup costs are manageable. A second is that a competitor attempts to take over BP, either in cooperation with the company or as a hostile bid. The share price would vary according to political pressure and factors related to the suitor and/or BP. A third scenario is that the leak is stopped but with delays. There is uncertainty of the clean up payments. BP stock prices rebound but not completely. A fourth scenario is that the leak is not resolved, political pressure continues leading to bankruptcy.[94] yeaaaaabiochhh There are speculations in the press, based chiefly on comments from Fred Lucas, Energy Analyst at J.P. Morgan Cazenove, that there would be a takeover of the company, focusing on possible bids from Exxon or Shell at a presumed price of £88 billion.[95] In addition, BP executives have held talks with a number of sovereign wealth funds including from Abu Dhabi, Kuwait, Qatar and Singapore, for creation of a strategic partnership to avoid takeover by other major oil companies.[96] BP has either rejected or refused to react to these overtures.

Following the Oil Spill, on July 27, 2010, BP announced a net loss of $16.97 billion during the second quarter of 2010, with the oil spill costing $32.2 billion so far.[97] Also on July 27, 2010, BP confirmed that CEO Hayward would resign and be replaced by Bob Dudley on October 1, 2010.[97]

Mist mountain project

There have been some calls by environmental groups for BP to halt its "Mist Mountain" Coalbed Methane Project in the Southern Rocky Mountains of British Columbia and for the UN to investigate the mining activities.[98] The proposed 500 km² project is directly adjacent to the Waterton-Glacier International Peace Park.[99]

Canadian oil sands

BP is one of numerous firms who are extracting oil from Canadian oil sands, a process that produces four times as much CO2 as conventional drilling.[100] The Cree First Nation describe this as 'the biggest environmental crime on the planet'.[101]

Safety record

1965: Sea Gem offshore oil rig disaster

In December 1965, while the BP oil rig Sea Gem was being moved, two of its legs collapsed and the rig capsized. Thirteen crew were killed. Sea Gem was the first British offshore oil rig.[102]

2005: Texas City Refinery explosion

In March 2005, BP's Texas City, Texas refinery, one of its largest refineries, exploded causing 15 deaths, injuring 180 people and forcing thousands of nearby residents to remain sheltered in their homes.[103] A large [clarification needed]column filled with hydrocarbon overflowed to form a vapour cloud, which ignited. The explosion caused all the casualties and substantial damage to the rest of the plant. The incident came as the culmination of a series of less serious accidents at the refinery, and the engineering problems were not addressed by the management. Maintenance and safety at the plant had been cut as a cost-saving measure, the responsibility ultimately resting with executives in London.[104]

The fall-out from the accident continues to cloud BP's corporate image because of the mismanagement at the plant. There have been several investigations of the disaster, the most recent being that from the U.S. Chemical Safety and Hazard Investigation Board[105] which "offered a scathing assessment of the company." OSHA found "organizational and safety deficiencies at all levels of the BP Corporation" and said management failures could be traced from Texas to London.[103]

The company pleaded guilty to a felony violation of the Clean Air Act, was fined $50 million, and sentenced to three years probation.

On 30 October 2009, the US Occupational Safety and Health Administration (OSHA) fined BP an additional $87 million—the largest fine in OSHA history—for failing to correct safety hazards revealed in the 2005 explosion. Inspectors found 270 safety violations that had been previously cited but not fixed and 439 new violations. BP is appealing that fine.[103][106] (see #Environmental record).

2006–2010: Refinery fatalities and safety violations

From January 2006 to January 2008, three workers were killed at the company's Texas City, Texas refinery in three separate accidents. In July 2006 a worker was crushed between a pipe stack and mechanical lift, in June 2007, a worker was electrocuted, and in January 2008, a worker was killed by a 500-pound piece of metal that came loose under high pressure and hit him.[107]

Under scrutiny after the Texas City Refinery explosion, two BP-owned refineries in Texas City, and Toledo, were responsible for 97 percent (829 of 851) of wilful safety violations by oil refiners between June 2007 and February 2010, as determined by inspections by the Occupational Safety and Health Administration. Jordan Barab, deputy assistant secretary of labour at OSHA, said "The only thing you can conclude is that BP has a serious, systemic safety problem in their company."[108]

2009: North Sea helicopter accident

On 1 April 2009, a Bond Offshore Helicopters Eurocopter AS332 Super Puma ferrying workers from BP's platform in the Miller oilfield in the North Sea off Scotland crashed in good weather killing all 16 on board.[109][110]

2010: Deepwater Horizon well explosion

The 20 April 2010 explosion on BP's offshore drilling rig in the Gulf of Mexico resulted in the death of eleven people and caused the biggest accidental marine oil spill in the history of the petroleum industry.[111][112][113]

Political record

2007: Propane price manipulation

Four BP energy traders in Houston were charged with manipulating prices of propane in October 2007. As part of the settlement of the case, BP paid the US government a $303 million fine, the largest commodity market settlement ever in the US. The settlement included a $125 million civil fine to the Commodity Futures Trading Commission, $100 million to the Justice Department, $53.3 million to a restitution fund for purchasers of the propane BP sold, and $25 million to a US Postal Service consumer fraud education fund.[114][115]

2008: Oil price manipulation

In May 2010, the Supreme Court of Arbitration of the Russian Federation agreed in support of the country’s antimonopoly service’s decision to a 1.1 billion Ruble fine ($35.2 million) against TNK/BP, a 50/50 joint venture, for abusing antitrust legislation and setting artificially high oil products prices in 2008, TNK and BP declined comment.[116]

Baku-Tbilisi-Ceyhan pipeline

BP has been criticised for its involvement with Baku-Tbilisi-Ceyhan pipeline, due to human rights, environmental and safety concerns.[117]

Colombian pipeline

In July 2006, a group of Colombian farmers won a multi million pound settlement from BP after the company was accused of benefiting from a regime of terror carried out by Colombian government paramilitaries to protect the 450-mile (720 km) Ocensa pipeline.[118]

Contributions to political campaigns

According to the Center for Responsive Politics, BP is the United States' hundredth largest donor to political campaigns, having contributed more than US$5 million since 1990, 72% and 28% of which went to Republican and Democratic recipients, respectively. BP has lobbied to gain exemptions from U.S. corporate law reforms.[119] Additionally, BP paid the Podesta Group, a Washington, D.C.-based lobbying firm, $160,000 in the first half of 2007 to manage its congressional and government relations.[120]

In February 2002 BP's chief executive, Lord Browne of Madingley, renounced the practice of corporate campaign contributions, noting: "That's why we've decided, as a global policy, that from now on we will make no political contributions from corporate funds anywhere in the world."[121]

Despite this, in 2009 BP used nearly US$16 million to lobby US Congress, breaking the company's previous record (from 2008) of US$10.4 million.[122]

BP and Russia

BP is one of the few Western energy companies with major investments in Russia, a country which has failed to obey the Energy Charter Treaty. It has been subject to controversies. In 2008 Igor Sechin, a former GRU agent and later official in Vladimir Putin's government, did private negotiations with BP CEO.[123]

A report observed in January 2009:[124]

- Disruption to EU gas supplies in January 2009 - as Ukraine quarrelled with Russia and pipelines were shut down - exposed EU reliance on Russian gas. A dependence that does not support EU energy security, but does support BP's financial security. That financial security depends on BP maintaining its position as a bridge between Russian resources and EU customers. Given the company's turbulent relationships in Russia, BP draws on the EU to help it maintain that position. The EU assists BP because, while it may not be in the long term interests of the EU to depend upon Russian gas, EU energy policy currently relies on it. Without BP, it would have to rely on Russian state companies, most notably Gazprom. As TNK-BP is currently the only major oil and gas company in Russia with no state involvement, and the only major energy company in the country not majority-controlled by Russians, it is a key partner for the EU.

BP's Russian joint venture filed bankcrupty in June 2010.[125]

In 2003 The Guardian published intelligence reports that the GRU has allocated money towards hiring or training eco-warriors and mercenaries to sabotage the 1,100-mile Baku–Tbilisi–Ceyhan pipeline project, which was under construction and would have reduced Europe's energy dependence on Russia. The consortium was headed by BP.[126] During the 2008 war, the pipeline was a major target of Russian forces.[127]

BP corporate and retail brands

Corporate branding

BP Amoco changed its name to BP in 2000, and introduced a new corporate slogan: “Beyond Petroleum.” It replaced its “Green Shield” logo with the Helios symbol, a green and yellow sunflower pattern similar to the emblem of the Green Party of Canada. These changes were intended to highlight the company’s interest in alternative and environmentally friendly fuels. In July 2006, critics pointed to the relative lack of press coverage about a spill of 270,000 gallons of crude oil that spread into the Alaskan tundra. Critics noted this as evidence that BP had successfully greenwashed its image, while maintaining environmentally unsound practices.[128][129]

In 2008, BP was awarded a satirical prize, the "Emerald Paintbrush" award, by Greenpeace UK. The "Emerald Paintbrush" award was given to BP in order to highlight its alleged greenwashing campaign. Critics point out that while BP advertises its relatively minimal investment in alternative energy sources, the majority of its investments continue to go into fossil fuels.[130] BP was also one nominee for the 2009 Greenwash Awards.[131]

BP

Until 31 December 1998 the company was formally registered as the British Petroleum Company plc. In January 1999 following a merger the company took on the Amoco name.[132] The new name BP Amoco plc was retained until May 2001.[133][134] The transition to the BP plc name was managed by BP's advertising agency, Ogilvy & Mather and PR consultants, Ogilvy PR. The change of name culminated in BP's new logo and re-branding in the first quarter of 2001.[135]

The Helios logo (Helios is the name of the Greek sun god), represents energy in its many forms. The company owns the two letter internet domain bp.com, which the company registered 10 November 1989. BP is among the earliest brands to own such a short domain name.[136] BP's tagline is "Beyond Petroleum"; according to the company this represents their focus on meeting the growing demand for fossil fuels, manufacturing and delivering more advanced products, and enabling the material transition to a lower carbon future.[137]

By the end of July 2010, independent BP station owners reported sales down 10 to 40 percent in the quarter after the Gulf oil spill and, while some hoped BP would return to the Amoco brand once used by many of the stations, others considered that would be a gamble because BP put so much effort into the brand.[138]

ampm

ampm is a convenience store chain with branches located in several U.S. states including Arizona, California, Nevada, Ohio, Oregon, Washington, recently in Illinois, Indiana, Georgia and Florida, and in several countries worldwide such as Japan. In the western US, the stores are usually attached to an ARCO gas station; elsewhere, the stores are attached to BP gas stations. BP Connect stations in the US are transitioning to the ampm brand.

Aral

In Germany and Luxembourg, BP operates its petrol retail chain under the name Aral after acquiring the majority of Veba Öl AG in 2001 and rebranding almost all of its BP filling stations to Aral.

ARCO

ARCO is BP's retail brand on the US West Coast in the seven Western states of California, Oregon, Washington, Nevada, Idaho, Arizona, and Utah. BP acquired ARCO (formerly the Atlantic Richfield Company) in 2000. ARCO is a popular "cash only" retailer, selling products refined from Alaska North Slope crude at the Cherry Point Refinery in Washington, a plant in Los Angeles, and at other contract locations on the West Coast.

BP Travel Center

BP Travel Centers are large scale destination sites located in Australia which on top of offering the same features of a BP Connect site with fuel and a Wild Bean Cafe, also feature major food-retail tenants such as McDonald's, KFC, Nando's and recently Krispy Kreme, with a large seating capacity food court. There are also facilities for long-haul truck drivers including lounge, showers and washing machines all in the same building. There are 4 travel centers located in South East Queensland: two on the Pacific Highway (Coomera and Stapylton) and two on the Bruce Highway (Caboolture). A fifth travel centre was opened in 2007 at Chinderah in northern New South Wales.

BP Connect

BP Connect is BP's flagship retail brand name with BP Connect Service stations being operated around the UK, Europe, USA, Australia, New Zealand, Bosnia and Herzegovina and other parts of the world. BP Connect sites feature the Wild Bean Cafe, which offers cafe-style coffee made by the staff and a selection of hot food as well as freshly baked muffins and sandwiches. The food offered in Wild Bean Cafe varies from each site. BP Connect sites usually offer table and chair seating and often an Internet kiosk. In the US, the BP Connect concept is gradually being transitioned to the ampm brand and concept. Some BP Connect sites around the UK ran in partnership with Marks & Spencer with the on-site shop being an M&S Simply Food instead of a BP Shop.

BP Express

BP Express was the flagship BP brand prior to the introduction of BP Connect in 2000. There are still some BP Express sites operating around the world but most have been either upgraded to Connect or changed to an alternative brand. BP Express offers a bakery service but doesn't have the selection of food offered in the Wild Bean Cafe and usually coffee is only available through a self service machine.

In the Netherlands BP is opening unmanned stations with no shops or employees. These stations are called BP Express.[139] Some of these stations used to be 'ordinary' BP stations, some are new to the BP network. Apart from these stations BP Express shopping does also exist in the Netherlands.

BP Shop

BP Shop is commonly used on smaller, mainly independently owned sites. Products vary in each BP Shop but consist usually of a selection of convenience store-style food and automotive products.

BP 2go

BP 2go is a franchise brand used for independently operated sites in New Zealand and is currently being rolled out throughout Australia (although not all BP 2go stores are franchises in Australia). BP 2go sites mainly operate in towns and outer suburbs in New Zealand. BP 2go offers similar bakery food to BP Connect but in a pre-packaged form. Some BP Express sites around New Zealand and Australia that were considered too small to be upgraded to BP Connect were given the option to change to BP 2go; others were downgraded to BP Shop. Staff at some BP 2go sites wear a different style of uniform to the rest of the BP branded sites; however in company-owned and operated 2go sites in Australia the same uniform is worn across all sites.

Castrol

Castrol is a brand of motor oil and other lubricants which is entirely a BP brand but tends to retain its separate identity.

Air BP and BP Shipping

Air BP is the aviation fuel arm, BP Marine the marine fuels and lubricants arm, and BP Shipping is the shipping arm within the BP group.

BP Shipping provides the logistics to move BP's oil and gas cargoes to market, as well as marine structural assurance[140] on everything that floats in the BP group. It manages a large fleet of vessels most of which are held on long-term operating leases. BP Shipping's chartering teams based in London, Singapore, and Chicago also charter third party vessels on both time charter and voyage charter basis.

The BP-managed fleet consists of Very Large Crude Carriers (VLCCs), one North Sea shuttle tanker, medium size crude and product carriers, liquefied natural gas (LNG) carriers, liquefied petroleum gas (LPG) carriers, and coasters. All of these ships are double-hulled.[141]

See also

- Oil fields operated by BP

- Shell-Mex and BP

- BP Solar

- BP Ford Abu Dhabi World Rally Team

- Deepwater Horizon oil spill

References

- ^ "Executive Compensation at BP". Retrieved 12 Jul. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ a b c "Annual Results 2009" (PDF). BP. 2 February 2010. Retrieved 11 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "''Annual Report and Accounts 2009'' (pdf)" (PDF). Retrieved 17 July 2010.

- ^ "BP plc 2009 Securities and Exchange Commission Form 20-F" (PDF) (Press release). BP plc. 2010. Retrieved 11 Jun. 2010.

{{cite press release}}: Check date values in:|accessdate=(help) - ^ "Across Atlantic, Much Ado About Oil Company's Name". The New York Times. 12 Jun. 2010. Retrieved 17 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ "Global 500 - Full List". Fortune. 26 July 2010. Retrieved 30 August 2010.

- ^ Steigerwald, Bill (10 Jun. 2008). "It's about time oil started defending itself". Townhall.com. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=and|date=(help) - ^ "Key facts and figures". BP p.l.c. Retrieved 30 August 2010.

- ^ "Group results - Second quarter and half year 2010" (PDF). BP p.l.c. Retrieved 30 August 2010.

- ^ "Two Westlake Park, Houston, TX : Hines Interests". Hines Interests. Retrieved 11 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ "BP in the United States". BP p.l.c. Retrieved 27 August 2010.

- ^ "Key facts and figures". BP p.l.c. Retrieved 27 August 2010.

- ^ "BP.com: History of BP - Post war". Retrieved 3 Jul. 2010.

In 1954, the board changed the company's name to The British Petroleum Company

{{cite web}}: Check date values in:|accessdate=(help) - ^ Tharoor, Ishaan (2 Jun. 2010). "A Brief History of BP". TIME magazine. Retrieved 3 Jul. 2010.

In 1954, in an attempt perhaps to move beyond its image as a quasi-colonial enterprise, the company rebranded itself the British Petroleum Company

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ a b c "Australian Dictionary of Biography". Adb.online.anu.edu.au. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ Yousof Mazandi, United Press, and Edwin Muller, Government by Assassination (Reader's Digest September 1951).

- ^ "Britain Fights Oil Nationalism". The New York Times. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ a b "BP: History at Funding Universe". Fundinguniverse.com. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ Sztucki, Jerzy (1984). Interim measures in the Hague Court. Brill Archive. p. 43. ISBN 9789065440938.

- ^ a b "How a Plot Convulsed Iran in '53 (and in '79)". The New York Times. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ "New York Times article, 1953". Partners.nytimes.com. 20 Aug. 1953. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ Kinzer, All the Shah's Men, (2003), pp. 195–6.

- ^ Everest, Larry. "Background to Confrontation". Revcom.us. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "Natural Gas and Alaska's Future: The Facts page 22" (PDF). Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "BP dossier". Sea-us.org.au. 21 Nov. 1999. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=and|date=(help) - ^ a b "Sohio timeline". Dantiques.com. 1 Jun. 1913. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=and|date=(help) - ^ "TNK appoints Sir Peter Walters". Prnewswire.co.uk. 13 Jun. 2002. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=and|date=(help) - ^ Poole, Robert W. "Privatisation". Econlib.org. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ Steve Lohr (19 November 1987). "Kuwait Has 10% Of B.P.; Price Put At $900 Million". The New York Times. Retrieved 11 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ "Britain drops a barrier to BP bid". New York Times. Associated Press. 5 Feb. 1988. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ "Organising for performance: how BP did it". Gsb.stanford.edu. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "Company Profile". chevron.com. Retrieved 5 May 2010.

- ^ "Royal Academy of Engineering". Raeng.org.uk. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "BP and Amoco in oil mega-merger". BBC News. 11 Aug. 1998. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ a b "BP Parent Company Name Change Following AGM Approval". BP.com. 1 May 2001. Retrieved 11 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ Brierley, David (4 Apr. 1999). "BP strikes it rich in America". The Independent. London. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ "BP Amoco Agrees Recommended Cash Offer To Buy Burmah Castrol For £3 ($4.7) Billion". BP.com. 14 March 2000. Retrieved 11 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ Life: The Observer Magazine - A celebration of 500 years of British Art - 19th March 2000

- ^ "BP sells chemical unit for £5bn". BBC News. 7 Oct. 2005. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ Raabe, Steve (2 Jun. 2005). "BP puts 100 gas stations up for sale in Colorado.(British Petroleum Company PLC)". Accessmylibrary.com. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ "Gas station signs of change". Nl.newsbank.com. 18 Nov. 2005. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ "Penny Shares Online: BP(BP.)". 10 July 2006. Archived from the original on 2007-08-07. Retrieved 11 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "BP Set to Leave Russia Gas Project" by Guy Chazan and Gregory White, Wall Street Journal, 22 June 2007 p. A3.

- ^ "BP to Sell Most Company-Owned, Company-Operated Convenience Stores to Franchisees" (Press release). BP. 15 Nov. 2007. Retrieved 5 Jun. 2010.

{{cite press release}}: Check date values in:|accessdate=and|date=(help) - ^ "BP CEO set to retire". Findarticles.com. 2007. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ Ian Cobain and Clare Dyer (2 May 2007). "BP's Browne quits over lie". Guardian. London. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ Wardell, Jane (27 July 2010). "BP replaces CEO Hayward, reports $17 billion loss". News & Observer. Associated Press. Retrieved 27 July 2010. [dead link]

- ^ "The Board". BP. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "Smart, Fearless Journalism". Mother Jones. Retrieved 17 July 2010.

- ^ "Ten Worst Corporations of 2000". Motherjones.com. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "The 10 Worst Corporations of 2005". Multinationalmonitor.org. 14 Oct. 2005. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=and|date=(help) - ^ "bp: Beyond Petroleum?". Uow.edu.au. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "SaveTheArctic.com". SaveTheArctic.com. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ GB application 1435945, British Petroleum CO, "Oil Clean-Up Method", published 12 May 1976

- ^ "Main Home". Energy Biosciences Institute. 27 Jul. 2006. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=and|date=(help) - ^ "Stop BP-Berkeley". Stop BP-Berkeley. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ Interviewer: Amy Goodman, Guest: Antonia Juhasz (5 May 2010). "BP Funnels Millions into Lobbying to Influence Regulation and Re-Brand Image". Amy Goodman's Weekly Column. Democracy Now.

{{cite episode}}: Cite has empty unknown parameter:|serieslink=(help) - ^ "Solar Completes Manufacturing Restructuring With Closure of Frederick, MD Factory | Press". BP. 26 March 2010. Retrieved 17 July 2010.

- ^ "BP Solar to provide PV solar systems to Wal-Mart in California". Ecoseed.org. 23 April 2009. Retrieved 30 July 2010.

- ^ "Global Climate Coalition". Sourcewatch. Retrieved 11 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ mindfully.org (13 Feb. 2001). "How green is BP?". Mindfully.org. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=and|date=(help) - ^ "Scripps Institution". Scrippsco2.ucsd.edu. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "BP Exploration [Alaska] Pleads Guilty To Hazardous Substance Crime Will Pay $22 Million, Establish Nationwide Environmental Management System". United States Environmental Protection Agency. 23 September 1999. Retrieved 11 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ Mark Tran (19 July 2006). "BP shuts leaking Alaskan wells". The Guardian. London.

- ^ "Alaska Oil Spill Fuels Concerns Over Arctic Wildlife, Future Drilling". News.nationalgeographic.com. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "Alaska Update". BP. 2 October 2006.

- ^ Andrew Clark in New York (1 May 2007). "BP accused of 'draconian' cost cuts prior to Alaskan pipeline spill". Guardian. London. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ "Methanol and crude spill from Prudhoe Bay pipeline". 2 News KTUU.com. Associated Press. 16 October 2007. Archived from the original on 2007-11-13. Retrieved 11 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ By T.J. Aulds (5 June 2010). "The Galveston County Daily News". Galvestondailynews.com. Retrieved 17 July 2010.

- ^ "BP Texas Refinery Had Huge Toxic Release Just Before Gulf Blowout". ProPublica. Retrieved 17 July 2010.

- ^ "Oil estimate raised to 35,000-60,000 barrels a day". CNN. 15 Jun. 2010. Retrieved 15 Jun. 2010.

{{cite news}}:|first=has generic name (help);|first=missing|last=(help); Check date values in:|accessdate=and|date=(help) - ^ http://howmanygallonsspilled.com/. Retrieved 17 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help); Missing or empty|title=(help) - ^ Macdonald, Ian R.; Amos, John; Crone, Timothy; Wereley, Steve (21 May 2010). "The Measure of an Oil Disaster". The New York Times. The New York Times Company. Retrieved 1 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help); More than one of|first1=and|first=specified (help); More than one of|last1=and|last=specified (help) - ^ Gillis, Justin (18 May 2010). "Giant Plumes of Oil Forming Under the Gulf". The New York Times. The New York Times Company. Retrieved 18 May 2010.

- ^ Bigg, Matthew (3 May 2010). "Progress toward Gulf oil well cap". Reuters. Retrieved 13 May 2010.

- ^ "BP vows to pay all costs of oil spill cleanup". CBC. CBC News services. 3 May 2010. Retrieved 10 May 2010.

- ^ Daily Mail special investigation article: Why is BP taking ALL the blame? http://www.dailymail.co.uk/news/article-1287226/GULF-OIL-SPILL-Whys-BP-taking-blame.html

- ^ "Salazar: Oil spill 'massive' and a potential catastrophe". CNN. 2 May 2010. Retrieved 1 May 2010.

- ^ "Guard mobilized, BP will foot bill". Politico. Capitol News Company LLC. 1 May 2010. Retrieved 1 May 2010.

- ^ White, Ronald D. (30 April 2010). "For BP, oil spill is a public relations catastrophe". Los Angeles Times. Retrieved 1 May 2010.

- ^ "First quarter 2010 results". British Petroleum. BP p.l.c. 27 April 2010. Retrieved 19 May 2010.

- ^ a b Brenner, Noah (17 Jun. 2010). "Hayward says spill 'never should have happened'". Upstream Online. NHST Media Group. Retrieved 17 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ "White House: BP Will Pay $20B Into Gulf Spill Fund". NPR. 16 Jun. 2010.

{{cite news}}: Check date values in:|date=(help) - ^ Weisman, Jonathan; Chazan, Guy (16 Jun. 2010). "BP Halts Dividend, Agrees to $20 Billion Fund for Victims". The Wall Street Journal. Dow Jones & Company. Retrieved 16 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ "BP to fund $20bn Gulf of Mexico oil spill payout". BBC News. 16 Jun. 2010. Retrieved 16 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ "STATE OF ALABAMA et al v. BP, PLC et al". ACE Insurance Litigation Watch. 28 June 2010.

{{cite news}}: Text "]" ignored (help) - ^ a b c d e f g "BP turns to next attempt after top kill fails". Associated Press. 14 July 2010.

{{cite news}}:|access-date=requires|url=(help); Unknown parameter|http://news.ca.msn.com/top-stories/cbc-article.aspx?cp-documentid=ignored (help) - ^ "BP.com ownership statisics". 31 December 2009. Retrieved 23 September 2010.

- ^ Young, Sarah (4 June 2010). "BP resists pressure to cut dividend | Reuters". In.reuters.com. Retrieved 17 July 2010.

- ^ "BP May Not Survive After Gulf of Mexico Spill, Arbuthnot Says". BusinessWeek. 1 June 2010. Retrieved 17 July 2010.

- ^ Swint, Brian (2 June 2010). "BP at Risk as Share Plunge Fuels Takeover Speculation". Bloomberg. Retrieved 17 July 2010.

- ^ Tseng, Nin-Hai (7 June 2010). "BP after the spill: Bankrupt, bought, or business as usual?". CNN Money. Retrieved 10 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ "StanChart makes case for PetroChina-BP deal". Reuters. 10 June 2010. Retrieved 10 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help); Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ Denning, Liam (12 June 2010). "Is BP Stock a 'Buy' Now? Investors Review the Scenarios - WSJ.com". Online.wsj.com. Retrieved 17 July 2010.

- ^ Mason, Rowena (29 Jun. 2010). "Exxon or Shell should buy BP for £88bn, says analyst". The Telegraph. London. Retrieved 6 Jul. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ "'BP seeking strategic partners'". Upstream Online. NHST Media Group. 6 Jul. 2010. Retrieved 6 Jul. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ a b http://www.cnbc.com/id/38423142

- ^ Earthjustice Asks UN & International Joint Commission to Address Mining and Gas Drilling Threats To Glacier National Park[dead link]

- ^ Citizens concerned about project

- ^ The tactics of these rogue climate elements must not succeed.

- ^ Cree aboriginal group to join London climate camp protest over tar sands.

- ^ "The Story of the Sea Gem, the first rig to discover North Sea Gas in the UK sector". Dukes Wood Oil Museum. Retrieved 13 June 2010.

- ^ a b c ""Gulf oil spill: BP has a long record of legal, ethical violations" 8 May 2010 by McClatchy Washington Bureau". Mcclatchydc.com. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "Baker Panel Report". Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "U.S. Chemical Safety And Hazard Investigation Board Investigation Report on the BP Refinery Explosion and Fire of 23 March 2005 and BP's Safety Culture" (PDF). Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ Associated Press, "BP fined record $87 million for safety breaches", 31 October 2009.

- ^ Mark Collette (17 January 2008). "Attorney: Equipment failed in BP death". The Daily News. Retrieved 11 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ J. Morris and M.B. Pell (16 May 2010). "Renegade Refiner: OSHA Says BP Has "Systemic Safety Problem"". The Center for Public Integrity. Retrieved 11 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ Times of London, Helicopters grounded by BP as hope ends for sixteen lost in crash, Melanie Reid, 2 April 2009, accessed 1 June 2010, http://www.timesonline.co.uk/tol/news/uk/scotland/article6025461.ece

- ^ Times of London, All 16 on board North Sea Helicopter killed in crash, 2 April 2009, David Byers, http://www.timesonline.co.uk/tol/news/uk/scotland/article6020787.ece

- ^ Estimates Suggest Spill Is Biggest in U.S. History

- ^ ""Bird Habitats Threatened by Oil Spill" from National Wildlife". National Wildlife Federation. 30 Apr. 2010. Retrieved 3 May 2010.

{{cite web}}: Check date values in:|date=(help) - ^ Gulf Oil Slick Endangering Ecology (web streaming). CBS Broadcasting. 30 Apr. 2010. Retrieved 1 May 2010.

{{cite AV media}}: Check date values in:|date=(help) - ^ Houston Chronicle, Four BP traders charges with price manipulation, 25 Oct 2007, accessed 28 May 2010, http://www.chron.com/disp/story.mpl/business/5245852.html

- ^ US Dept of Justice, BP to pay More than $373 million in environmental crimes, fraud cases, 25 Oct 2007 press release, http://www.justice.gov/opa/pr/2007/October/07_ag_850.html

- ^ Platts, Russian supreme court backs antitrust fines against TNK-BP, 26 May 2010, accessed 1 June 2010, Nadia Rodova, http://www.platts.com/RSSFeedDetailedNews.aspx?xmlpath=RSSFeed/HeadlineNews/Oil/8751289.xml

- ^ "The Baku Ceyhan Pipeline: BP's Time Bomb". Gnn.tv. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ Verkaik, Robert (22 Jul. 2006). "BP pays out millions to Colombian farmers". The Independent. London. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ "BP". The Center For Responsive Politics.

- ^ "BP". The Center for Responsive Politics.

- ^ Terry Macalister and Michael White (16 April 2002). "BP stops paying political parties". Guardian. London. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ Juhasz, Antonia (2 May 2010). "BP spends millions lobbying as it drills ever deeper and the environment pays". The Observer. UK. Retrieved 6 May 2010.

- ^ White, Gregory L.; Chazan, Guy (12 June 2008). "Boardroom Brawl Roils BP's Russia Venture - Talks Break Down; Kremlin's Role Murky". Wall Street Journal.

- ^ "BP and the Russian Bear" (PDF). Corporate Europe Observatory. January 2009.

- ^ "BP's Russian Joint Venture Files for Bankruptcy at Kovykta". Eurasia Daily Monitor Volume: 7 Issue: 112. 10 June 2010.

- ^ "Russia accused of plot to sabotage Georgian oil pipeline". London: The Guardian. 1 December 2003.

- ^ McElroy, Damien (10 August 2008). "Georgia: Russia targets key oil pipeline with over 50 missiles". London: The Telegraph.

- ^ Monbiot, George (13 June 2006). "Behind the spin, the oil giants are more dangerous than ever". The Guardian. London. Retrieved 26 April 2010.

- ^ "Edinburgh Evening News". Edinburghnews.scotsman.com. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "BP wins coveted 'Emerald Paintbrush' award for worst greenwash of 2008". Greenpeace.org.uk. 22 December 2008. Retrieved 1 May 2010.

- ^ "BP – nominated for green spin on the activities of the company". Climategreenwash.org. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ www.secinfo.com/

- ^ UK Companies House website

- ^ P.R. WEEK, US EDITION, 17 April 2000, P23.

- ^ “Charlex creates BP spot” www.charlex.com/news/BP/BP.press.html

- ^ "BP.com ranks 7 on the VB.com Internet Hall of Fame". Vb.com. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "Beyond petroleum". BP. Retrieved 6 May 2010.

- ^ Weber, Harry (30 July 2010). "Time to scrap BP brand? Gas-station owners divided". News & Observer. Associated Press. Retrieved 30 July 2010. [dead link]

- ^ "Bespaar tijd en geld" (in Dutch). BP Europa SE – BP Nederland. Retrieved 6 May 2010.

- ^ "Marine Assurance". Bp.com. 1 January 2008. Retrieved 17 July 2010.

- ^ "BP Shipping Fleet". Bp.com. Retrieved 17 July 2010.

Further reading

- Ferrier, R.W. (1982). The History of the British Petroleum Company: The Developing Years 1901–1932. Vol. vol. I. Cambridge: Cambridge University Press. ISBN 0521246474.

{{cite book}}:|volume=has extra text (help); Cite has empty unknown parameter:|coauthors=(help) - Bamberg, James H (1994). The History of the British Petroleum Company: The Anglo-Iranian Years, 1928–1954. Vol. vol. II. Cambridge: Cambridge University Press. ISBN 0521259509.

{{cite book}}:|volume=has extra text (help); Cite has empty unknown parameter:|coauthors=(help) - Bamberg, James H (2000). The History of the British Petroleum Company: British Petroleum and Global Oil, 1950–1975: The Challenge of Nationalism. Vol. vol. III. Cambridge: Cambridge University Press. ISBN 0521259517.

{{cite book}}:|volume=has extra text (help); Cite has empty unknown parameter:|coauthors=(help) - Meyer, Karl E (2008). Kingmakers: The Invention of the Modern Middle East. New York: W.W. Norton. ISBN 97803930619944.

{{cite book}}: Check|isbn=value: length (help); Unknown parameter|coauthors=ignored (|author=suggested) (help)

External links

- Official website

- BP's Corporate History

- BP Solar

- BP Whiting Refinery Information

- Company details, list of subsidiaries, and major shareholders

- Statistical Review of World Energy

- BP's YouTube page