| Formerly | Farmers' Fire Insurance and Loan Company (1822–1836) |

|---|---|

| Company type | Private |

| Industry | Banking |

| Founded | 1822 |

| Defunct | 1959 |

| Fate | Acquired by First National City Bank |

| Successor | City Bank-Farmers Trust Company (1929-1963) Citibank |

| Headquarters | City Bank-Farmers Trust Building, , United States |

Key people |

The Farmers' Loan and Trust Company was a national bank headquartered in New York City that later became Citibank.

History[edit]

On February 28, 1822, the New York State Legislature granted a charter to the Farmers' Fire Insurance and Loan Company with capital stock of $500,000 which could be increased to $1,000,000 "when expedient".[1] At the first meeting of the board of directors on March 9, 1822, John T. Champlin, the largest individual stockholder, was chosen president and served until his death in 1830.[1] In 1836, its name was changed to the Farmers' Loan and Trust Company.[1]

In 1879, Roswell G. Rolston served as president and George F. Talman was vice president. The members of the executive committee of the board of directors were Moses Taylor (president of National City Bank), John Jacob Astor III, Isaac Bell Jr. (a cotton broker who was the U.S. Minister to the Netherlands), Talman, Samuel Sloan (president of the Delaware, Lackawanna and Western Railroad), Edward Minturn (of Grinnell, Minturn & Co.), and Rolston. In 1880, Robert Lenox Kennedy (a nephew of James Lenox) replaced Minturn on the executive committee.[2]

Mergers[edit]

On June 1, 1929, the Farmers' Loan and Trust Company merged with the National City Bank where National City Bank took over the expanded bank's banking operations, while Farmers' Trust became the City Bank-Farmers Trust Company, an affiliate subsidiary of National City Bank, that took over the trust operations.[3] Two years later, the Trust Company merged with the Bank of America Trust Company to become New York's largest financial institution.

In February 1940, the company, as trustee, purchased the Hotel Knickerbocker on West 42nd Street in Manhattan at auction for $742,500 in foreclosure proceedings against the Kerback Realty Corporation and others.[4] In 1942, the firm celebrated its 120th anniversary.[5]

In January 1959, the shareholders approved a name change from City Bank Farmers Trust Company to First National City Trust Company which involved a shift of the trust company's status from that of a state-chartered to a national bank.[6] In 1963, the company merged into the First National City Bank (which itself was a result of the 1955 merger of the National City Bank and the First National Bank into The First National City Bank of New York;[7] which was shortened to First National City Bank in 1962).[8] In 1976, the First National City Bank's name was changed to Citibank, N.A.

Company headquarters[edit]

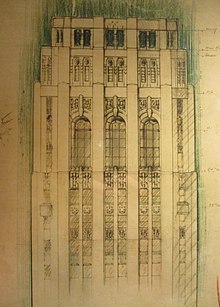

The company's first office was a private dwelling at 34 Wall Street. Upon the completion of the Merchant's Exchange Building in 1827, Farmers' moved its headquarters there, remaining until the Great Fire of New York destroyed the building in 1835. After renting office space since its inception,[a] the company purchased a plot of land in 1882 for $120,000 on William Street and built a two and a half story building which it used as its headquarters from 1889 until 1890. In February 1889 it purchased the adjacent plot for $250,000 and built a new building 16-22 William Street at a total construction cost of $1,064,159.19 for the old and new building.[1] The architect of the new eight-storey office structure was C. W. Clinton and David H. King, Jr. received the contract for the entire work.[9] By 1908, the business had again outgrown its space so it purchased the property of the Delaware, Lackawanna and Western Railroad Company for $625,000 at the corner of William and Exchange Place, north and west of the plots already owned by the company. The new building was completed in 1909 at a cost of $1,476,037.84.[1][10][11]

Between 1930 and 1931, the bank tore down its existing headquarters,[b] and built a new fifty-nine story structure known as the City Bank-Farmers Trust Building at 20 Exchange Place, which became one of New York City's tallest buildings.[13][14] The steel-framed structure sheathed in granite and limestone was designed in the Art Deco style by Cross & Cross.[15] The building served as the company's headquarters until 1956 and the City Bank-Farmers Trust Building was eventually sold by Citigroup in 1979.

Notable employees[edit]

List of presidents:[1]

- 1822–1830: John T. Champlin

- 1830–1832: Oliver H. Hicks

- 1832–1832: Frederick A. Tracy

- 1832–1835: Elisha Tibbets

- 1835–1837: Henry Seymour

- 1837–1842: Lewis Curtis

- 1842–1842: Charles Stebbins

- 1842–1845: Robert C. Cornell

- 1845–1865: Douw D. Williamson[16]

- 1865–1898: Rosewell G. Rolston[17]

- 1898–1921: Edwin S. Marston[18]

- 1921–1929: James H. Perkins[19]

- 1936–1951: Lindsay Bradford[20]

- 1951–1957: Richard S. Perkins[21]

- 1957–1959: Eben W. Pyne[22][23]

Other notable employees:[1]

- Archibald McIntyre; Secretary (1822–1823)

- Rufus King Delafield; Secretary (1836–1852)[24]

- Samuel Sloan Jr.; Secretary (1897–1907), Vice-President (1907)[25]

- William B. Cardozo[26]

References[edit]

- Notes

- ^ The company offices from 1822 to 1827 were 34 Wall Street; from 1827 to 1835 were 55 Wall Street; from 1839 to 1848 were 16 Wall Street; from 1848 to 1852 were 50 Wall Street; from 1852 to 1859 were 28 Exchange Place; from 1859 to 1866 were 56 Wall Street; from 1866 to 1882 were 26 Exchange Place; from 1882 to 1889 were 20-22 William Street.[1]

- ^ Farmers' tore down four structures: two 10-story buildings on William Street, one 9-story building on Hanover Street, and one 15-story building extending between Beaver Street and Exchange Place.[12]

- Sources

- ^ a b c d e f g h Lanier, Henry Wysham (1922). A Century of Banking in New York: 1822-1922. Gilliss Press. pp. 275–296. Retrieved 18 June 2021.

- ^ "The Farmers' Loan and Trust Company". The New York Times. January 6, 1880. Retrieved 18 June 2021.

- ^ Hansen, B. (2009). Institutions, Entrepreneurs, and American Economic History: How the Farmers' Loan and Trust Company Shaped the Laws of Business from 1822 to 1929. Palgrave Macmillan US. p. 5. ISBN 978-0-230-61913-5. Retrieved May 21, 2020.

- ^ "Hotel Sold at Auction – Knickerbocker Acquired by City Bank Farmers Trust Co". The New York Times. February 3, 1940. p. 28. Retrieved 18 June 2021.

- ^ "City Bank Farmers Trust Is 120 Years Old Today". The New York Times. February 28, 1942. p. 23. Retrieved 18 June 2021.

- ^ "Proxy Fight Role of Big Bank Aired – First National City Said at Times to Vote Trust Stock Against Management". The New York Times. January 14, 1959. Retrieved 18 June 2021.

- ^ United States. Congress (1957). Congressional Record: Proceedings and Debates of the ... Congress. U.S. Government Printing Office. p. 1348. Retrieved May 21, 2020.

- ^ Times, Special to The New York (January 4, 1963). "National City Hit 10 Billion in 1962 – Reports Record Resources – Operating Earnings Up – Wells Fargo Down Wells Fargo Bank Security First National Bank – Annual Reports Issued by Banks – United California Bank Union Bank Chemical Bank Crocker Anglo National Bank Morgan Guaranty Trust". The New York Times. Retrieved 18 June 2021.

- ^ "Important Buildings Under Way. South of 14th Street" (PDF). Real Estate Record and Builders Guide. 43 (1106): 728. May 25, 1889.

- ^ "City Bank to Move With $50,000,000; New Quarters in Remodeled Old Custom House Will Be Occupied on Saturday". The New York Times. December 13, 1908. ISSN 0362-4331. Retrieved May 20, 2020.

- ^ van B. Cleveland, Harold & Huertas, Thomas F. (1985). Citibank 1812-1970. Harvard University Press. p. 54.

- ^ "New City Bank Complete Today: Fuller Co., Builders, Finish Farmers Trust Skyscraper Ahead of Schedule". Wall Street Journal. March 16, 1931. p. 16. ISSN 0099-9660. Retrieved August 11, 2020 – via ProQuest.

- ^ Landmarks Preservation Commission 1996, p. 7.

- ^ Bonner 1924, p. 417.

- ^ "City Bank-Farmers Trust Company Building". hdc.org. Historic Districts Council. Retrieved 18 June 2021.

- ^ "Died". The New York Times. January 5, 1897. Retrieved 18 June 2021.

- ^ "Rosewell G. Rolston Dead – Well-Known Business Man Passed Away at His Summer Home – Health Poor for a Year – Stricken with Paralysis in April of Last Year, He Never Fully Recovered – Wife and Three Children Survive". The New York Times. August 26, 1898. Retrieved 18 June 2021.

- ^ "Edwin S. Marston Dies Suddenly at 71 – Ex-President of Farmers Loan and Trust Co. Stricken at His New Jersey Country Home – Bank's Head for 24 Years – Director in Many Important Corporations Was a Native of New York City". The New York Times. October 13, 1922. Retrieved 18 June 2021.

- ^ "James H. Perkins, Banker, Is Dead. Chairman of Board of National City Organization Stricken in Mt. Kisco at 64. Was Red Cross Official. Head of American Service in Europe During War. Was Cited for His Work". The New York Times. July 13, 1940. Retrieved June 18, 2021.

James Handasyd Perkins, chairman of the board of the National City Bank of New York and president of the City Bank Farmers Trust Company, died tonight following a heart attack suffered shortly after he and Mrs. Perkins had dined at the home here of Arthur M. Anderson ...

- ^ "L. Bradford, 67, Retired Banker – Former President of City Farmers Trust Dies-Honored by Colgate". The New York Times. October 7, 1959. Retrieved 18 June 2021.

- ^ "City Bank Farmers Trust Advances Two". The New York Times. December 5, 1951. Retrieved 18 June 2021.

- ^ "City Bank Farmers Promotes Two". The New York Times. January 3, 1957. Retrieved 18 June 2021.

- ^ Saxon, Wolfgang (April 13, 2007). "Eben Pyne 89, Who Helped Revive Suburban Railroads, Dies". The New York Times. Retrieved 18 June 2021.

- ^ Pelletreau, William Smith (1907). Historic Homes and Institutions and Genealogical and Family History of New York. Lewis Publishing Company. p. 279. Retrieved 18 June 2021.

- ^ "Samuel Sloan, 75 – A Retired Banker – Ex-Senior Vice President of the City Bank Farmers Trust Co. Dies After Long Illness – On Many Directorates – Served Board of Lackawanna Road, Which His Father Had Headed – Active in Charity". The New York Times. November 27, 1939. Retrieved 16 June 2021.

- ^ "William Cardozo, Veteran Banker – Senior Vice President of the City Bank Farmers Trust Co. Served It for 58 Years – Office Boy at Age of – Known as Authority on Realty and Trust Administration – Dies in Home at 74". The New York Times. June 4, 1940. Retrieved 18 June 2021.

Works cited[edit]

- City Bank–Farmers Trust Company Building (PDF) (Report). New York City Landmarks Preservation Commission. June 25, 1996. Archived from the original (PDF) on July 16, 2012.

- Bonner, William T. (1924). New York the World's Metropolis. Commemorative Edition. pp. 407–408.