Positive abnormal return (α): Above-average returns that cannot be explained as compensation for added risk

Negative abnormal returns (α): Below-average returns that cannot be explained by below-market risk

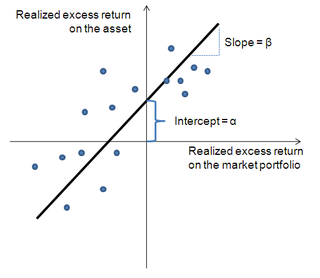

Security characteristic line (SCL) is a regression line,[1] plotting performance of a particular security or portfolio against that of the market portfolio at every point in time. The SCL is plotted on a graph where the Y-axis is the excess return on a security over the risk-free return and the X-axis is the excess return of the market in general. The slope of the SCL is the security's beta, and the intercept is its alpha.[2]

Formula[edit]

where:

- αi is called the asset's alpha (abnormal return)

- βi(RM,t – Rf) is a nondiversifiable or systematic risk

- εi,t is the non-systematic or diversifiable, non-market or idiosyncratic risk

- RM,t is the return to market portfolio

- Rf is a risk-free rate

Well, that’s interesting to know that Psilotum nudum are known as whisk ferns. Psilotum nudum is the commoner species of the two. While the P. flaccidum is a rare species and is found in the tropical islands. Both the species are usually epiphytic in habit and grow upon tree ferns. These species may also be terrestrial and grow in humus or in the crevices of the rocks.

View the detailed Guide of Psilotum nudum: Detailed Study Of Psilotum Nudum (Whisk Fern), Classification, Anatomy, Reproduction